Severity: Notice

Message: Undefined variable: content_category

Filename: user/transcript.php

Line Number: 106

Severity: Warning

Message: Invalid argument supplied for foreach()

Filename: user/transcript.php

Line Number: 106

1) 2016 BDO Tax Outlook Survey 2016 BDO TAX OUTLOOK SURVEY 1

2) 2016 BDO Tax Outlook Survey The BDO Tax Outlook Survey of Tax Directors is a national telephone survey conducted by Market Measurement, Inc., an independent market research consulting firm, whose executive interviewers spoke directly to 150 tax directors, or those with tax director responsibilities, at public companies using a survey conducted within a scientifically developed, pure random sample. Material discussed in this publication is meant to provide general information and should not be acted on without professional advice tailored to your individual needs. © 2016 BDO USA, LLP. All rights reserved. www.bdo.com 2

3) 2016 BDO Tax Outlook Survey Tax Reform Takes Center Stage in 2016 The Protecting Americans from Tax Hikes Act of 2015 (PATH Act) may be the last significant tax bill of the Obama administration. With the 2016 presidential election looming, tax directors are closely watching how America’s choice will impact the tax reform landform landscape—and by proxy, their financial reporting and tax planning strategies. Eight months before the 2016 presidential election, the tax reform debate has reached a boiling point, with candidates from both parties proposing significant changes to federal tax policy. But according to a recent ABC News / Washington Post Poll, just 6 percent of voters who lean Republican and 4 percent of those who lean Democrat rank taxes as the most important issue impacting their vote. The same cannot be said of tax directors, for whom changes to the tax code can mean significant profit lost or gained and impact financing and investment decisions for their organizations. With the election outcome unclear, one in five public company tax directors say planning for reform under the next president is their primary tax concern at this time, according to the second annual BDO USA, LLP Tax Outlook Survey. When asked if the outcome of the presidential election will or will not result in significant tax code changes, 77 percent of public company tax directors indicated they believe tax reform will pass if the next president is a Republican. Thirty-three percent believe tax reform will pass if the next president is a Democrat. Topping tax directors’ reform wish list is reducing the corporate tax rate (41 percent), which at a top federal marginal rate of 35 percent, is among the highest in the industrialized world. Other tax reform proposals they would most like to see include a shift to a territorial tax system (20 percent) and a simplified tax code (19 percent). Just 2 percent cite lowering the tax burden on capital gains as a high priority. of tax directors believe tax reform will pass if the next president is a Republican 33% believe tax reform will pass if the next president is a Democrat 2% Top Tax Policy Changes on Tax Directors’ Wish Lists Reduced corporate tax rate 77% 4% 13% Shift to a territorial tax system Simplified tax code Tax incentives to repatriate foreign earnings 41% 19% Repeal the Cadillac Tax Lower tax burden on capital gains 20% 1

4) 2016 BDO Tax Outlook Survey “The real challenge for businesses in an election year is planning for uncertainty. The recent vacancy on the Supreme Court has only heightened the partisan divide; however, the compromise to make permanent a number of important tax extenders reached at the end of last year may portend additional opportunities to find common ground.” Matthew Becker, partner in the national Tax practice at BDO Top Tax Issues Weighing on Tax Directors 2% 3% International Tax Planning & BEPS Planning for tax reform under the next president 12% Attributional nexus concepts Growing scrutiny on foreign earnings 15% 48% Tax on “cloud” based transactions Tax benefits like carried interest 21% 2 SPOTLIGHT ON The PATH Act The Protecting Americans from Tax Hikes Act of 2015 (PATH Act) was signed into law on December 18, along with a FY 2016 omnibus. The Act does considerably more than the typical tax extenders legislation seen in prior years, which many taxpayers had criticized as being too short-lived to rely on for meaningful strategic planning. It makes permanent over 20 key tax provisions, including the research tax credit, enhanced Code Sec. 179 expensing and the American Opportunity Tax Credit. It also extends some provisions, including bonus depreciation for five years and many others for two years. In addition, many extenders have been enhanced, and the Act imposes a two-year moratorium on the ACA medical device excise tax. The PATH Act is the first significant tax legislation passed since the American Tax Relief Act of 2012, and may be the last major tax bill of the Obama administration. The tax measures in the Act are expansive and are expected to help nearly all individuals and businesses across all sectors of the economy.

5) 2016 BDO Tax Outlook Survey “BEPS is one of the most ambitious reform initiatives ever undertaken on an international scale. Between the election in November and BEPS implementation in the U.S. and overseas, the tax regulatory and reporting environment is in a state of major flux. The BEPS recommendations may be applied differently by different countries, which is creating more uncertainty and confusion for multinational businesses. As we wait to see how implementation unfolds, businesses should closely monitor the adoption of BEPS to determine the potential tax consequences and review their internal compliance controls and procedures.” Paul Heiselmann, national managing partner of Specialized Tax Services at BDO International Tax Planning in the Post-BEPS Era Major tax reform efforts on the international stage are also a source of anxiety for tax directors as they look to optimize global growth, with 55 percent saying they plan to enter or expand international markets in 2016. On Monday, October 5, 2015, the Organisation for Economic Co-operation and Development (OECD) issued its long-awaited final recommendations to address tax base erosion and profit shifting (BEPS) by multi-national enterprises. First introduced in July 2013, the 15-point action plan is designed to shape “fair, effective and efficient tax systems” and address issues arising from tax planning strategies that exploit gaps or mismatches in member countries’ tax rules. Now that the OECD has finalized the BEPS initiative, tax directors will need to prepare their organizations to meet new global tax rules and requirements. Nearly half (48 percent) of respondents say international tax planning, including BEPS, is their biggest tax issue for 2016. Of the 15 items listed in the BEPS Action Plan, the recommendations on transfer pricing (Action Items 8, 9, 10 and 13) pose the greatest concern, cited by 54 percent of survey participants. Transfer pricing is top of mind for good reason: 81 percent of tax directors say their organization’s current tax strategy includes transfer pricing mechanisms. While much of the BEPS agenda still awaits implementation, more than half (52 percent) of respondents are proactively taking steps based on the Action Item recommendations. Another third are waiting for individual countries to implement BEPS measures before taking any action. BEPS has reporting implications as early as this year, with country-by-country reporting rules taking effect for tax years starting on or after January 1, 2016. These requirements are covered under Action 13, which addresses changes to transfer pricing documentation standards. Most tax directors (87 percent) expect to have completed the country-by-country analysis by the December 31, 2017 deadline for the first report. 3

6) 2016 BDO Tax Outlook Survey SPOTLIGHT ON BEPS An overview of the OECD’s 15-point BEPS Action Plan Action Item 1: Addressing the Tax Challenges of the Digital Economy The “next step” recommendation in the report on Action Item 1 is to monitor closely the combined effect of all Action Items on the digital economy, via a “detailed mandate to be developed in 2016” and a digital economy report to be produced by 2020. Action Item 2: Neutralize the Effects of Hybrid Mismatch Arrangements Action Item 2 targets hybrid mismatch arrangements—arrangements that exploit differences in the tax treatment of an entity or instrument under the laws of two or more tax jurisdictions to achieve double non-taxation, including long-term deferral. Action Item 3: Designing Effective Controlled Foreign Company (CFC) Rules Action Item 3 addresses the need for developing a global framework for CFC rules, which generally provide an antideferral mechanism within a taxation system to trigger current taxation of an item of income to prevent shifting income between jurisdictions. Action Item 4: Limiting Base Erosion Involving Interest Deductions and Other Financial Payments Action Item 4 addresses the risk of BEPS through interest deductions, identifying three basic scenarios involving such risk. The OECD’s recommended approach to limit interest deductions is based on a fixed ratio rule. Action Item 5: Countering Harmful Tax Practices More Effectively, Taking into Account Transparency and Substance Action Item 5 aims to “revamp the work on harmful tax practices with a priority on improving transparency, including compulsory spontaneous exchange on rulings relating to preferential regimes, and on requiring substantial activity for any preferential regime.” 4 Action Item 6: Prevent Treaty Abuse Action Item 6 addresses the inappropriate use of tax treaty benefits and includes recommendations to counter treaty shopping arrangements. Action Item 7: Preventing the Artificial Avoidance of Permanent Establishment Status Action Item 7 includes changes to the definition of permanent establishment in Article 5 of the OECD Model Tax Convention to prevent commissionaire structures and similar strategies. Action Items 8-10: Aligning Transfer Pricing Outcomes with Value Creation Action Items 8- 10 were released in a single report addressing transactions involving intangibles, risk and capital transfers between group entities, as well as other high-risk transactions. XXAction Item 8 recommends the adoption of a broad and clearly delineated definition of intangibles, which will ensure that profits associated with the transfer and use of intangible property are appropriately allocated in accordance with value creation. XXAction Item 9 outlines transfer pricing rules or special measures to ensure that an entity does not accrue inappropriate returns solely based on contractually assumed risk or the provision of capital. XXAction Item 10 recommends the adoption of transfer pricing rules or special measures to clarify the re-characterization of transactions and the application of transfer pricing methods with respect to global value chains, as well as to provide protection against common types of base eroding payments. Action Item 11: Monitoring and Measuring BEPS Action 11 establishes methodologies to collect and analyze data on BEPS and the actions to address it, develops recommendations regarding indicators of the scale and economic impact of BEPS, and ensures that tools are available to monitor and evaluate the effectiveness and economic impact of the actions taken to address BEPS on an ongoing basis. Action Item 12: Mandatory Disclosure Rules Action Item 12 sets out recommendations for designing an effective disclosure regime to counter the BEPS concerns of each country. Action Item 13: Guidance on Transfer Pricing Documentation and Country-byCountry Reporting Action Item 13 contains recommendations for transfer pricing documentation, which relies on a three-tiered approach and a revised template for country-by-country reporting to enhance transparency. Action Item 14: Making Dispute Resolutions More Effective Action Item 14 develops solutions to address obstacles that prevent countries from solving treaty-related disputes under mutual agreement procedures in an effective and timely manner, via a minimum standard and a number of best practices. It also includes arbitration as an option for willing countries. Action Item 15: Developing a Multilateral Instrument to Modify Bilateral Tax Treaties Action Item 15 provides for the development of a multilateral instrument designed to modify existing bilateral tax treaties in order to swiftly implement the tax treaty measures developed in the course of the BEPS project. The goal is to conclude work and open the multilateral instrument by December 31, 2016.

7) 2016 BDO Tax Outlook Survey “The PATH Act has finally brought the R&D credit’s 35-year roller-coaster history of expiration and eleventh-hour renewal to an end. Companies of all sizes can now reliably use the credit to offset tax liability and increase cash flow. Its new permanency and expanded availability helps the credit fulfill its original intent: to foster homegrown innovation.” Chris Bard, practice leader for Specialized Tax Services, Research and Development at BDO. The PATH Act Expands R&D Credit Eligibility The landmark Protecting Americans from Tax Hikes Act (PATH Act) passed in December 2015 has put a spotlight on the federal research and development (R&D) credit, which is available to taxpayers with specified increases in business-related qualified research expenditures and for increases in payments to universities and other qualified organizations for basic research. The Act permanently extends and modifies the credit to benefit smaller companies. Businesses with gross receipts less than $50 million can now claim the credit against their Alternative Minimum Tax, and startups with annual gross receipts of less than $5 million can take up to $250,000 in credit against their payroll taxes for up to five years. According to BDO’s Tax Outlook Survey, 70 percent of respondents are taking advantage of both federal and state R&D credits; 30 percent are only claiming the federal credit. For those organizations not claiming R&D credits, 52 percent say they made the decision based on the assumption that they did not qualify. With the passage of the PATH Act, other reasons cited for not claiming the credits will no longer be relevant for the 2016 tax year, including the alternative minimum tax bar (22 percent), the planning challenges of the annual renewal process (13 percent) and the assumption that an organization is too small to benefit (13 percent). What’s Driving Tax Directors to Not Claim the Federal R&D Credit 52% Not doing “ground-breaking” work 44% Cost of pursuing the credit Alternative Minimum Tax bar 22% Lack necessary documentation 22% Unpreditictable annual renewal 13% Company is too small to benefit 13% Audit concerns 13% 5

8) 2016 BDO Tax Outlook Survey “Tax directors also have their eye on tax reform at the state and local level as tax law changes are enacted and new incentive programs come into play. Controversy over the taxation of the digital and service-based economy has been percolating over the last few years, and tax directors will be watching to see how states approach taxing borderless transactions.” Rocky Cummings, tax partner and head of National Multistate Tax Services at BDO. Tax Directors Weigh State and Local Tax Considerations Looking beyond R&D incentives, tax directors are leveraging the following strategies to minimize their tax burden at the state and local level: XX89 percent claim income or franchise tax credits and exemptions XX89 percent claim sales tax refunds and exemptions XX82 percent claim property tax abatements and exemptions XX46 percent take advantage of training grants XX32 percent take advantage of financing programs 6 Just under a fourth (24 percent) of tax directors expect their organization to enter a new geographic market in the United States in the next year. For those respondents anticipating domestic expansion, income or franchise tax credits and exemptions and property tax abatements and exemptions have equal weight in impacting their decision to enter new markets (50 percent each).

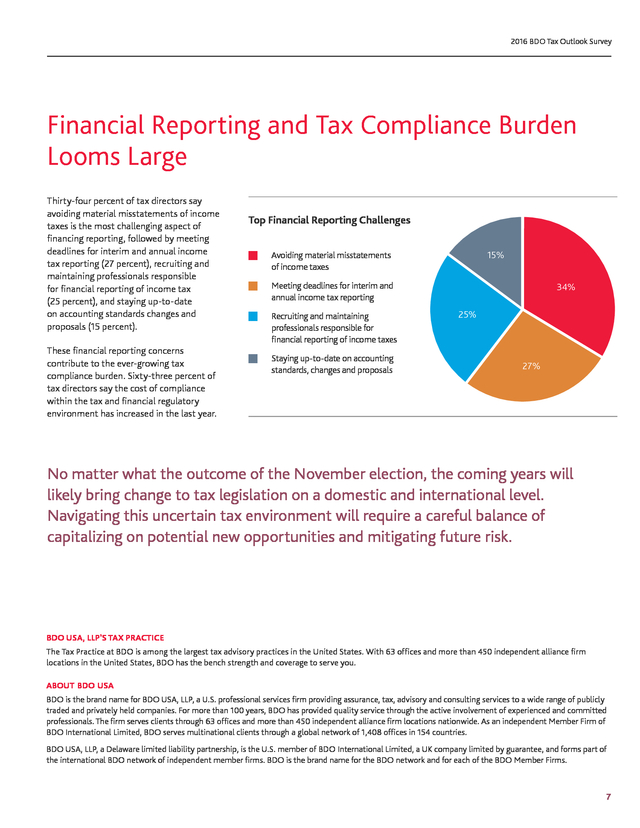

9) 2016 BDO Tax Outlook Survey Financial Reporting and Tax Compliance Burden Looms Large Thirty-four percent of tax directors say avoiding material misstatements of income taxes is the most challenging aspect of financing reporting, followed by meeting deadlines for interim and annual income tax reporting (27 percent), recruiting and maintaining professionals responsible for financial reporting of income tax (25 percent), and staying up-to-date on accounting standards changes and proposals (15 percent). These financial reporting concerns contribute to the ever-growing tax compliance burden. Sixty-three percent of tax directors say the cost of compliance within the tax and financial regulatory environment has increased in the last year. Top Financial Reporting Challenges 15% Avoiding material misstatements of income taxes Meeting deadlines for interim and annual income tax reporting Recruiting and maintaining professionals responsible for financial reporting of income taxes Staying up-to-date on accounting standards, changes and proposals 34% 25% 27% No matter what the outcome of the November election, the coming years will likely bring change to tax legislation on a domestic and international level. Navigating this uncertain tax environment will require a careful balance of capitalizing on potential new opportunities and mitigating future risk. BDO USA, LLP’S TAX PRACTICE The Tax Practice at BDO is among the largest tax advisory practices in the United States. With 63 offices and more than 450 independent alliance firm locations in the United States, BDO has the bench strength and coverage to serve you. ABOUT BDO USA BDO is the brand name for BDO USA, LLP, a U.S. professional services firm providing assurance, tax, advisory and consulting services to a wide range of publicly traded and privately held companies. For more than 100 years, BDO has provided quality service through the active involvement of experienced and committed professionals. The firm serves clients through 63 offices and more than 450 independent alliance firm locations nationwide. As an independent Member Firm of BDO International Limited, BDO serves multinational clients through a global network of 1,408 offices in 154 countries. BDO USA, LLP, a Delaware limited liability partnership, is the U.S. member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms. BDO is the brand name for the BDO network and for each of the BDO Member Firms. 7

10) 2016 BDO Tax Outlook Survey For more information on BDO USA’s service offerings, please contact one of the following regional practice leaders: MATTHEW BECKER ROCKY CUMMINGS JOSEPH CALIANNO Grand Rapids 616-802-3413 mkbecker@bdo.com San Jose 408-352-1962 rcummings@bdo.com 202-904-2402 jcalianno@bdo.com PAUL HEISELMANN CHRIS BARD YOSEF BARBUT Chicago 312-233-1876 pheiselmann@bdo.com Los Angeles 310-557-7525 cbard@bdo.com New York (212) 885-8292 ybarbut@bdo.com TODD SIMMENS ROBERT PEDERSEN BOB HARAN Woodbridge 732-491-4170 tsimmens@bdo.com New York 212-885-8398 rpedersen@bdo.com Boston (617) 239-4165 bharan@bdo.com ANDREW GIBSON Atlanta 404-979-7106 agibson@bdo.com CONTACT US: FIRST NAME LAST NAME EMAIL PHONE SUBJECT MESSAGE SUBMIT 8