Severity: Notice

Message: Undefined variable: content_category

Filename: user/transcript.php

Line Number: 106

Severity: Warning

Message: Invalid argument supplied for foreach()

Filename: user/transcript.php

Line Number: 106

1) Aviation and Aerospace M&A Quarterly Q3 2015 ICF International (formerly ICF SH&E) is pleased to present the ninth edition of Aircraft, Airlines, Aerospace & Airport M&A Quarterly, published in association with Mergermarket. The publication highlights M&A activity and trends in the aerospace, aircraft finance, airline, and airport markets in Q3 2015. The highest-value deal, not only in Q3, but also in the history of the aerospace sector, was Berkshire Hathaway’s US$36bn acquisition of metal and industrial components manufacturer Precision Castparts. This transaction significantly eclipsed the largest aerospace deal of the Introduction Aircraft previous quarter, which was the acquisition of Pexco Aerospace by TransDigm Group for US$496m in cash. The top five deals in Q3 2015 were all above US$1bn, whereas only the top two deals in the prior quarter surpassed US$1bn. Airlines Aerospace Airport Tech Quarterly Spotlights Ranking Target Company Bidder Company Deal Value US$(m) Sector 1 Precision Castparts Berkshire Hathaway 36,000 Aerospace 2 Sikorsky Aircraft Corporation Lockheed Martin Corporation 9,000 Aerospace 3 Avolon Holdings Bohai Leasing 7,000 Aircraft 4 Nordic Aviation Capital EQT VI and Kirkbi Invest 3,300 Aircraft 5 Swissport International HNA Group 2,800 Airport 1 About ICF Aviation and Aerospace M&A Quarterly Q3 2015

2) Q2 and Q3 2015 M&A Volume and Value Introduction 35 60,000 Aircraft Airlines 30 Aerospace 50,000 Airport 25 Tech 40,000 Volume 30,000 15 Value (US$m) 20 Quarterly Spotlights About ICF 20,000 10 10,000 5 0 Key Q2 volume 2 Aircraft Q3 volume Airlines Q2 value Aerospace Q3 value Airport Technology 0 Aviation and Aerospace M&A Quarterly Q3 2015

3) Aircraft Introduction Leasing Deals Remain Significant Aircraft Airlines Aerospace Continuing a long-running trend that has spanned several quarters, aircraft leasing deals again stole the headlines in the aircraft sector in the third quarter of 2015. Airport Tech The most significant transaction in this segment saw Chinese specialist finance leasing firm, Bohai Leasing, acquire 100% of Irish aircraft lessor and lease management company, Avolon Holdings, valuing the company at US$7.3bn. Bohai had initially bid for a 20% stake in Avolon in July 2015, but increased its bid to 100% following an undisclosed rival bid for all of the Dublin-based company’s share capital. A definitive merger agreement was reached between the two companies on September 3 for US$31 per Avolon share – slightly lower than the initial offer price of US$32 per share. Avolon attributes this change to “significant volatility across global equity markets”. Nonetheless, valued at approximately 1.7 times book value, very significantly above current trading prices for other lessors. The transaction is expected to close by the first quarter of 2016. It is anticipated that Bohai will integrate the operations of its existing aircraft leasing platform Hong Kong Aviation Capital with those of Avolon. 3 On announcing the takeover in September, Avolon chairman Denis Naydon said that Bohai would “enhance Avolon’s profile, positioning and relationships in the Chinese aviation market – a market which we believe offers one of the most compelling growth opportunities in global aviation over the next two decades”. The Avolon deal highlights an ongoing Chinese interest in the buoyant aircraft leasing market. It follows on from a Q2 transaction which saw China agree with Russia’s United Aircraft Corporation (UAC) to form a leasing company based in Xixian, with the specific purpose of marketing the Sukhoi Superjet 100 aircraft in Asia. Press reports have cited interest from several Chinese companies in acquiring AWAS, the aircraft lessor acquired by Terra Firma in 2006. Leasing activity also spread to Scandinavia in the third quarter, with Swedish private equity group, EQT, agreeing to acquire a majority stake in Denmark’s Nordic Aviation Capital (NAC) in a deal valued at US$3.3bn. Quarterly Spotlights About ICF Aviation and Aerospace M&A Quarterly Q3 2015

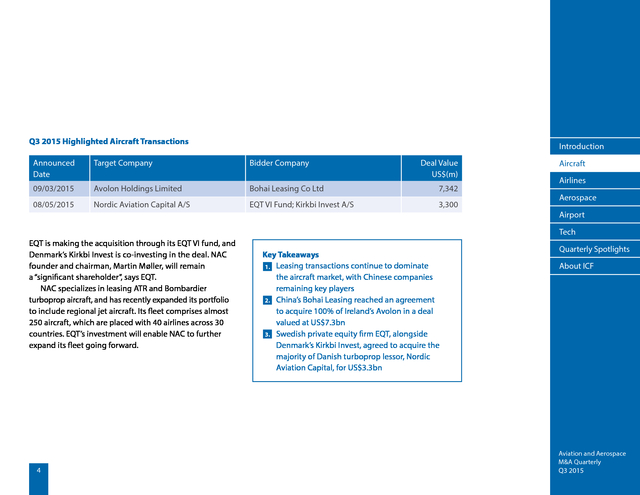

4) Q3 2015 Highlighted Aircraft Transactions Introduction Announced Date Target Company Bidder Company Deal Value US$(m) 09/03/2015 Avolon Holdings Limited Bohai Leasing Co Ltd 7,342 08/05/2015 Nordic Aviation Capital A/S EQT VI Fund; Kirkbi Invest A/S 3,300 Aircraft Airlines Aerospace Airport Tech EQT is making the acquisition through its EQT VI fund, and Denmark’s Kirkbi Invest is co-investing in the deal. NAC founder and chairman, Martin Møller, will remain a “significant shareholder”, says EQT. NAC specializes in leasing ATR and Bombardier turboprop aircraft, and has recently expanded its portfolio to include regional jet aircraft. Its fleet comprises almost 250 aircraft, which are placed with 40 airlines across 30 countries. EQT’s investment will enable NAC to further expand its fleet going forward. 4 Key Takeaways 1. Leasing transactions continue to dominate the aircraft market, with Chinese companies remaining key players 2. China’s Bohai Leasing reached an agreement to acquire 100% of Ireland’s Avolon in a deal valued at US$7.3bn 3. Swedish private equity firm EQT, alongside Denmark’s Kirkbi Invest, agreed to acquire the majority of Danish turboprop lessor, Nordic Aviation Capital, for US$3.3bn Quarterly Spotlights About ICF Aviation and Aerospace M&A Quarterly Q3 2015

5) Airlines Introduction Delta Takes Equity Investment Strategy to China Aircraft Airlines Aerospace Delta Air Lines became the first US carrier to own a stake in a Chinese airline when it agreed to purchase 3.55% of China Eastern Airlines for US$450m in the third quarter. The Atlanta-based carrier agreed in July to acquire 10% of China Eastern’s H Shares, which trade on the Hong Kong Stock Exchange, equating to 3.55% of the Chinese airline’s total shares. Delta says the move marks a significant step in the two airlines’ collaboration and partnership, enabling them to compete more effectively on routes between the USA and China. It is also in line with China Eastern’s strategy to increase awareness of its brand and expand its business across a more global market. The deal is subject to approvals from both Chinese regulators and the Hong Kong Stock Exchange. This is not the first time Delta has acquired a minority interest in an international carrier. The deal follows a spate of similar investments by the airline, including the 2011 purchase of a 4% stake in Aeromexico and a 3% stake in Gol – improving its position in the Latin American market. Delta also agreed at the end of 2012 to acquire a 49% stake in UK-based Virgin Atlantic Airways from Singapore Airlines for US$360m. The China Eastern deal means the carrier now has equity investments in airlines spanning three continents. 5 Delta is not alone in pursuing a strategy of investing in international airlines. Rival US carrier United Airlines in Q2 acquired a 5% stake in Brazilian carrier Azul for US$100m, as part of a long-term strategic partnership. Airport Tech Quarterly Spotlights About ICF Saudia Sells Stake in Business Jet Unit Business jet operator PrivatAir Saudi Arabia has acquired a 30% stake in Saudi Private Aviation, the VIP charter subsidiary of national carrier Saudia. PrivatAir plans to restructure the company and renew its fleet. The sell-off is part of a wider privatization program at Saudia that has been ongoing for a number of years. New Holding Company Pins Hopes on UK Regionals UK-based carriers BMI Regional and Loganair have been brought together as part of a newly-created holding company called Airline Investments (AIL). AIL acquired Aviation and Aerospace M&A Quarterly Q3 2015

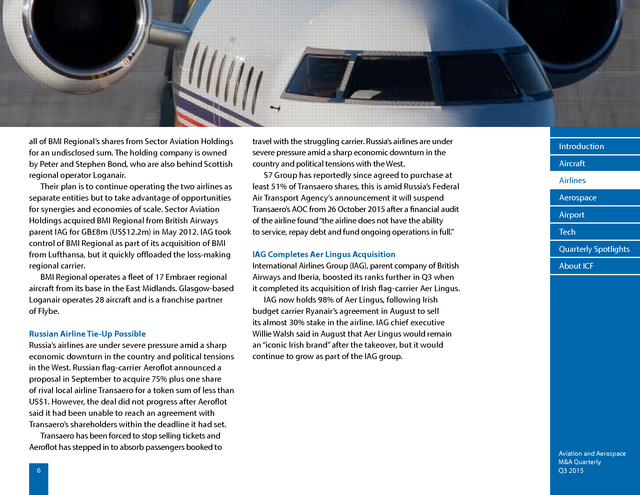

6) all of BMI Regional’s shares from Sector Aviation Holdings for an undisclosed sum. The holding company is owned by Peter and Stephen Bond, who are also behind Scottish regional operator Loganair. Their plan is to continue operating the two airlines as separate entities but to take advantage of opportunities for synergies and economies of scale. Sector Aviation Holdings acquired BMI Regional from British Airways parent IAG for GB£8m (US$12.2m) in May 2012. IAG took control of BMI Regional as part of its acquisition of BMI from Lufthansa, but it quickly offloaded the loss-making regional carrier. BMI Regional operates a fleet of 17 Embraer regional aircraft from its base in the East Midlands. Glasgow-based Loganair operates 28 aircraft and is a franchise partner of Flybe. Russian Airline Tie-Up Possible Russia’s airlines are under severe pressure amid a sharp economic downturn in the country and political tensions in the West. Russian flag-carrier Aeroflot announced a proposal in September to acquire 75% plus one share of rival local airline Transaero for a token sum of less than US$1. However, the deal did not progress after Aeroflot said it had been unable to reach an agreement with Transaero’s shareholders within the deadline it had set. Transaero has been forced to stop selling tickets and Aeroflot has stepped in to absorb passengers booked to 6 travel with the struggling carrier. Russia’s airlines are under severe pressure amid a sharp economic downturn in the country and political tensions with the West. S7 Group has reportedly since agreed to purchase at least 51% of Transaero shares, this is amid Russia’s Federal Air Transport Agency’s announcement it will suspend Transaero’s AOC from 26 October 2015 after a financial audit of the airline found “the airline does not have the ability to service, repay debt and fund ongoing operations in full.” IAG Completes Aer Lingus Acquisition International Airlines Group (IAG), parent company of British Airways and Iberia, boosted its ranks further in Q3 when it completed its acquisition of Irish flag-carrier Aer Lingus. IAG now holds 98% of Aer Lingus, following Irish budget carrier Ryanair’s agreement in August to sell its almost 30% stake in the airline. IAG chief executive Willie Walsh said in August that Aer Lingus would remain an “iconic Irish brand” after the takeover, but it would continue to grow as part of the IAG group. Introduction Aircraft Airlines Aerospace Airport Tech Quarterly Spotlights About ICF Aviation and Aerospace M&A Quarterly Q3 2015

7) Key Takeaways 1. Delta Air Lines agreed to purchase a 3.55% stake in China Eastern Airlines for US$450m, becoming the first US carrier to own a stake in a Chinese airline 2. Delta deal solidifies investment strategy of taking minority stakes in international airlines Introduction 3. 4. Aircraft BMI Regional becomes stablemate of Loganair under newly-created holding company IAG closes acquisition of Aer Lingus, while Transaero’s takeover may come from S7 rather than Aeroflot Airlines Aerospace Airport Tech Q3 2015 Highlighted Airlines Transactions Quarterly Spotlights Announced Date Target Company Bidder Company 07/27/2015 China Eastern Airlines Corporation Limited (3.55% Stake) Delta Air Lines Inc 07/03/2015 FAI rent-a-jet Aktiengesellschaft (51% Stake); FAI Asset Management Gmbh (50.1% Stake) Axtmann-Holdings GmbH 07/14/2015 Saudia Private Aviation Company Limited (30% Stake) PrivatAir Saudi Arabia Limited Not disclosed 08/03/2015 Loganair Limited; British Midland Regional Limited Airline Investments Limited Not disclosed 7 Deal Value US$(m) About ICF 450 67 Aviation and Aerospace M&A Quarterly Q3 2015

8) Aerospace Introduction Precision Castparts Deal Eclipses All Others Aircraft Airlines Aerospace In a transaction of monumental proportions, billionaire investor Warren Buffett’s Berkshire Hathaway fund agreed in Q3 to acquire metal components manufacturer Precision Castparts for US$36bn. Berkshire Hathaway already holds a 3% stake in the company. Portland, Oregon-based Precision Castparts is a world leader in structural investment castings, forged components and airfoil castings for airframes and aircraft engines. The company is a key supplier to aircraft manufacturers including Airbus and Boeing. Precision Castparts’ fiscal year 2015 revenue was US$10bn, about 70% of which was attributed to sales to the aviation and aerospace industry. Its multi-billion dollar acquisition by Berkshire Hathaway reflects the strong level of market confidence in the aerospace sector, where a doubling of the global commercial aircraft fleet is predicted over the next two decades. If completed, the deal will be Berkshire Hathaway’s largest-ever purchase and will expand the group’s aviation asset portfolio, which also includes NetJets and FlightSafety International. Announcing the deal in August, Buffett said: “I’ve admired PCC’s operation for a long time. For good reasons, 8 it is the supplier of choice for the world’s aerospace industry, one of the largest sources of American exports.” If the deal closes as expected in the first quarter of 2016, Precision Castparts will continue to conduct business under its own name from its Portland headquarters. Amid the noise created by the Berkshire Hathaway deal, Precision Castparts made an acquisition of its own in Q3. The company agreed to pay US$560m to MidOcean Partners and PSP Investments for Canadian airframe, engine and landing gear components manufacturer, Noranco. The acquisition will improve Precision Castparts’ competitive position, as emphasized by chairman and chief executive, Mark Donegan, on announcing the deal in July: “Noranco’s aerostructures business strengthens our existing market position in airframe products, and their engine, landing gear and machining capability will expand our product offering on current- and nextgeneration aircraft.” Airport Tech Quarterly Spotlights About ICF Aviation and Aerospace M&A Quarterly Q3 2015

9) Noranco has strong positions on next-generation aircraft including the Boeing 737, 787 and 777 and the Airbus A350 and A320. The transaction is expected to close in the third quarter of fiscal 2016, subject to regulatory approvals. Systems & Training (MST) division, which already partners with Sikorsky on several programs, including the VH-92 Presidential Helicopter, Combat Rescue Helicopter and the Naval MH-60 Helicopter. Lockheed Martin Makes Key Helicopter Acquisition Another significant aerospace acquisition in Q3 involved Lockheed Martin Corporation, which agreed to purchase global helicopter manufacturer Sikorsky Aircraft Corporation from United Technologies for US$9bn. The acquisition marks a return of Lockheed Martin to the business of manufacturing commercial aircraft – a market from which it has been virtually absent since it stopped building the TriStar L-1011 in the 1980s. It also forms part of the company’s strategy of diversifying away from government contracts. This latter point was highlighted by Lockheed Martin on announcing the Sikorsky acquisition in July, when it said it was considering selling off its government IT and technical services businesses. The company said it would conduct a strategic review of alternatives for these businesses as a result of recent shifts in global security market dynamics. “The strategic review is expected to result in a spin-off to Lockheed Martin shareholders or sale of these components,” Lockheed Martin said. The Sikorsky acquisition is expected to close either late in Q4 or early in Q1, subject to regulatory approvals. Lockheed Martin plans to align Sikorsky under its Mission Metals Giant Splits in Two Lightweight metals manufacturer, Alcoa, announced in September that it will separate into two independent, publicly-traded companies. The move is seen as an attempt to isolate its aerospace and vehicle divisions from its aluminium production unit, which has come under pressure due to stagnant global prices. Alcoa will divide into an ‘Upstream Company’, focusing on bauxite, alumina, aluminium, casting and energy – which will operate under the Alcoa brand – and a ‘Value-Add’ company, concentrating on global rolled products, engineered products, and transportation and construction solutions. This division will operate under a new name, which will be announced prior to completing the split in mid-2016. Alcoa says the Value-Add company “will be a differentiated supplier to the high-growth aerospace industry with leading positions on every major aircraft and jet engine platform, underpinned by market leadership in jet engine and industrial gas turbine airfoils, and aerospace fasteners”. 9 BBA Makes Landmark FBO Acquisition BBA Aviation has agreed to acquire fixed-base operation (FBO) provider and charter operator Landmark Aviation Introduction Aircraft Airlines Aerospace Airport Tech Quarterly Spotlights About ICF Aviation and Aerospace M&A Quarterly Q3 2015

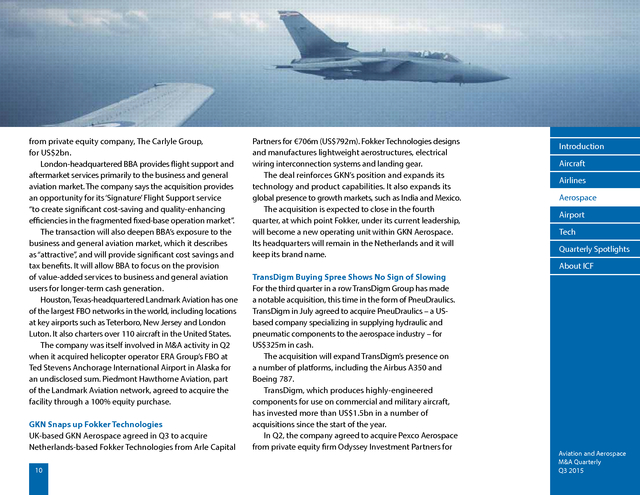

10) from private equity company, The Carlyle Group, for US$2bn. London-headquartered BBA provides flight support and aftermarket services primarily to the business and general aviation market. The company says the acquisition provides an opportunity for its ‘Signature’ Flight Support service “to create significant cost-saving and quality-enhancing efficiencies in the fragmented fixed-base operation market”. The transaction will also deepen BBA’s exposure to the business and general aviation market, which it describes as “attractive”, and will provide significant cost savings and tax benefits. It will allow BBA to focus on the provision of value-added services to business and general aviation users for longer-term cash generation. Houston, Texas-headquartered Landmark Aviation has one of the largest FBO networks in the world, including locations at key airports such as Teterboro, New Jersey and London Luton. It also charters over 110 aircraft in the United States. The company was itself involved in M&A activity in Q2 when it acquired helicopter operator ERA Group’s FBO at Ted Stevens Anchorage International Airport in Alaska for an undisclosed sum. Piedmont Hawthorne Aviation, part of the Landmark Aviation network, agreed to acquire the facility through a 100% equity purchase. GKN Snaps up Fokker Technologies UK-based GKN Aerospace agreed in Q3 to acquire Netherlands-based Fokker Technologies from Arle Capital 10 Partners for €706m (US$792m). Fokker Technologies designs and manufactures lightweight aerostructures, electrical wiring interconnection systems and landing gear. The deal reinforces GKN’s position and expands its technology and product capabilities. It also expands its global presence to growth markets, such as India and Mexico. The acquisition is expected to close in the fourth quarter, at which point Fokker, under its current leadership, will become a new operating unit within GKN Aerospace. Its headquarters will remain in the Netherlands and it will keep its brand name. Introduction Aircraft Airlines Aerospace Airport Tech Quarterly Spotlights About ICF TransDigm Buying Spree Shows No Sign of Slowing For the third quarter in a row TransDigm Group has made a notable acquisition, this time in the form of PneuDraulics. TransDigm in July agreed to acquire PneuDraulics – a USbased company specializing in supplying hydraulic and pneumatic components to the aerospace industry – for US$325m in cash. The acquisition will expand TransDigm’s presence on a number of platforms, including the Airbus A350 and Boeing 787. TransDigm, which produces highly-engineered components for use on commercial and military aircraft, has invested more than US$1.5bn in a number of acquisitions since the start of the year. In Q2, the company agreed to acquire Pexco Aerospace from private equity firm Odyssey Investment Partners for Aviation and Aerospace M&A Quarterly Q3 2015

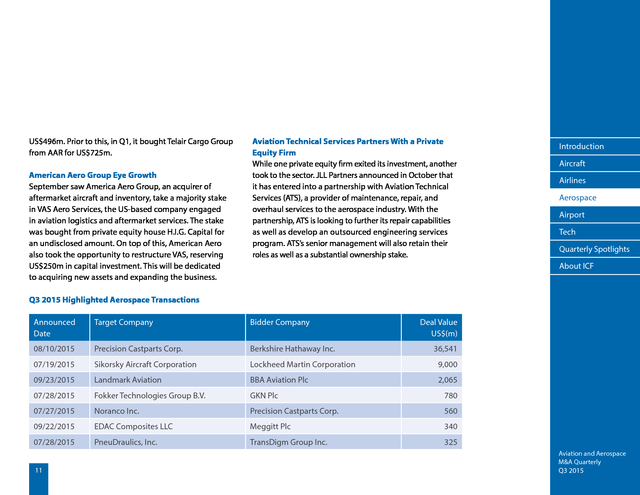

11) US$496m. Prior to this, in Q1, it bought Telair Cargo Group from AAR for US$725m. American Aero Group Eye Growth September saw America Aero Group, an acquirer of aftermarket aircraft and inventory, take a majority stake in VAS Aero Services, the US-based company engaged in aviation logistics and aftermarket services. The stake was bought from private equity house H.I.G. Capital for an undisclosed amount. On top of this, American Aero also took the opportunity to restructure VAS, reserving US$250m in capital investment. This will be dedicated to acquiring new assets and expanding the business. Aviation Technical Services Partners With a Private Equity Firm While one private equity firm exited its investment, another took to the sector. JLL Partners announced in October that it has entered into a partnership with Aviation Technical Services (ATS), a provider of maintenance, repair, and overhaul services to the aerospace industry. With the partnership, ATS is looking to further its repair capabilities as well as develop an outsourced engineering services program. ATS’s senior management will also retain their roles as well as a substantial ownership stake. Introduction Aircraft Airlines Aerospace Airport Tech Quarterly Spotlights About ICF Q3 2015 Highlighted Aerospace Transactions Announced Date Target Company Bidder Company 08/10/2015 Precision Castparts Corp. Berkshire Hathaway Inc. 07/19/2015 Sikorsky Aircraft Corporation Lockheed Martin Corporation 9,000 09/23/2015 Landmark Aviation BBA Aviation Plc 2,065 07/28/2015 Fokker Technologies Group B.V. GKN Plc 780 07/27/2015 Noranco Inc. Precision Castparts Corp. 560 09/22/2015 EDAC Composites LLC Meggitt Plc 340 07/28/2015 PneuDraulics, Inc. TransDigm Group Inc. 325 11 Deal Value US$(m) 36,541 Aviation and Aerospace M&A Quarterly Q3 2015

12) Airport Introduction Major airport ground handling transaction closes in the quarter while London city sale process starts Aircraft Airlines Aerospace China Takes Control of Swissport China’s HNA Group signed a definitive agreement in Q3 to acquire global ground handling and services provider, Swissport International, from European private equity firm PAI Partners for US$2.8bn. Following the acquisition, Swissport will remain as a standalone unit within HNA. The Haikou, China-based conglomerate is the parent company of Hainan Airlines, and has increasingly global interests across the aviation and airport management spectrum. Swissport plans to continue expanding its global footprint following the acquisition, which is expected to close by the end of the year. The Zurich-based company provides ground services for 224 million passengers and handles 4.1 million tons of freight a year. It is active at more than 270 stations in 48 countries across five continents, and generates consolidated operating revenue of US$3.1bn. Austria’s Klagenfurt Airport Sold to Private Investors A consortium led by private investors Hans Peter Haselsteiner and Gaston Glock has agreed to acquire 12 a 74% stake in Austria’s Klagenfurt Airport from KLH Karntner Landesholding for US$11m. The airport was previously jointly-owned by the local Governments of Carinthia and Klagenfurt. A public tender was not used to find a buyer due to the airport’s poor financial situation and the urgency with which a buyer was needed. The airport must renovate its runway by next year to avoid being closed down, and the new consortium has to fund those improvements. Klagenfurt Airport, also known as Karnten, is located in southern Austria and serves the country’s sixth-largest city. London City Owner Starts Sale Process The owners of the only London airport to reside within the boundaries of London (LCY) have initiated a tender process to sell the airport. Global Infrastructure Partners is looking to sell its 75% share of this largely O&D airport. Over the past three years, LCY has been the fastest growing airport in the UK and now ranks as one of the leading business airports serving London. The airport has the capability of doubling passengers, and this potential in a highly-constrained greater London market has led to suggestions that this asset could sell for as much Airport Tech Quarterly Spotlights About ICF Aviation and Aerospace M&A Quarterly Q3 2015

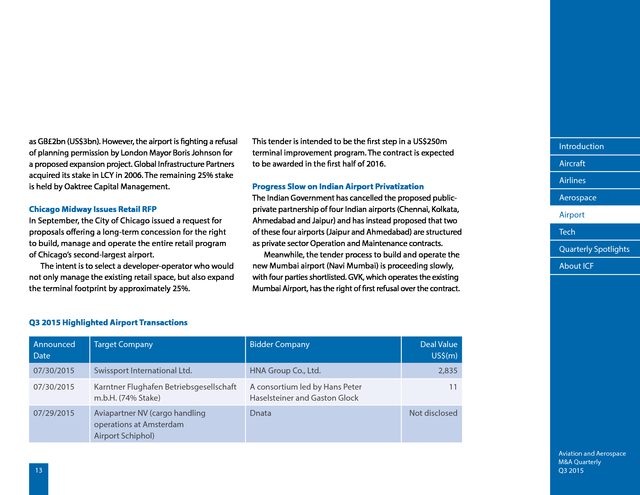

13) as GB£2bn (US$3bn). However, the airport is fighting a refusal of planning permission by London Mayor Boris Johnson for a proposed expansion project. Global Infrastructure Partners acquired its stake in LCY in 2006. The remaining 25% stake is held by Oaktree Capital Management. Chicago Midway Issues Retail RFP In September, the City of Chicago issued a request for proposals offering a long-term concession for the right to build, manage and operate the entire retail program of Chicago’s second-largest airport. The intent is to select a developer-operator who would not only manage the existing retail space, but also expand the terminal footprint by approximately 25%. This tender is intended to be the first step in a US$250m terminal improvement program. The contract is expected to be awarded in the first half of 2016. Progress Slow on Indian Airport Privatization The Indian Government has cancelled the proposed publicprivate partnership of four Indian airports (Chennai, Kolkata, Ahmedabad and Jaipur) and has instead proposed that two of these four airports (Jaipur and Ahmedabad) are structured as private sector Operation and Maintenance contracts. Meanwhile, the tender process to build and operate the new Mumbai airport (Navi Mumbai) is proceeding slowly, with four parties shortlisted. GVK, which operates the existing Mumbai Airport, has the right of first refusal over the contract. Introduction Aircraft Airlines Aerospace Airport Tech Quarterly Spotlights About ICF Q3 2015 Highlighted Airport Transactions Announced Date Target Company Bidder Company 07/30/2015 Swissport International Ltd. HNA Group Co., Ltd. 07/30/2015 Karntner Flughafen Betriebsgesellschaft m.b.H. (74% Stake) A consortium led by Hans Peter Haselsteiner and Gaston Glock 07/29/2015 Aviapartner NV (cargo handling operations at Amsterdam Airport Schiphol) Dnata 13 Deal Value US$(m) 2,835 11 Not disclosed Aviation and Aerospace M&A Quarterly Q3 2015

14) Tech Introduction CSC and SRA to Join Forces on Cybersecurity Aircraft Airlines Aerospace The most significant technology deal in Q3 saw CSC enter a definitive agreement to combine its government services unit, Computer Sciences Government Services, with SRA after a spin-off of that unit which was announced in May. CSC provides technology solutions to a number of sectors, including aerospace and defence. SRA is owned by a group led by Providence Equity Partners. The US$1.3bn deal is expected to close in November. The combination of the two companies will bring together highly complementary IT capabilities, particularly in the field of cybersecurity, which has been pushed up the priority list in the airline industry with the onset of in-flight connectivity. Honeywell Buys Green Software Company Honeywell Aerospace has acquired Aviaso, an aviation software company specializing in developing fuelefficiency and emissions-saving software for the airline industry. The terms of the deal have not been disclosed. The software developed by Zurich, Switzerlandheadquartered Aviaso gathers data on aircraft usage to identify ways in which airlines can use a software interface to reduce their fuel consumption. 14 The acquisition enables Honeywell to strengthen its service offering and broaden its presence in Europe. On announcing the deal, Honeywell vice-president of marketing and product management, Carl Esposito, said: “Aviaso brings new products to our broad aerospace services offerings, along with several opportunities for Honeywell to offer our airline customers a full suite of services that improve aircraft performance and safety. “This acquisition strengthens Honeywell’s leadership in delivering energy-efficient solutions to our airlines customers, and adds increasingly valuable fuel management services to our growing services portfolio.” Amadeus acquires Navitaire from Accenture After a number of transactions in previous quarters involving global distribution system (GDS) providers, Amadeus joined the fray in Q3 with its US$830m acquisition of airline support services company Navitaire from consulting firm Accenture. Airport Tech Quarterly Spotlights About ICF Aviation and Aerospace M&A Quarterly Q3 2015

15) Navitaire provides revenue-management solutions to the low-cost segment of the airline industry. Its portfolio will complement Amadeus’ Altea suite of services, which Amadeus says will enable it to serve a much wider group of airlines. The deal is expected to close in the fourth quarter. The largest tech deal for Q3 saw CSG combine its Computer Sciences Government Services with SRA for US$1.4bn Introduction Aircraft Airlines Aerospace Airport Q3 2015 Highlighted Technology Transactions Tech Announced Date Target Company 07/01/2015 SRA International, Inc. (84.68% Stake) Computer Sciences Government Services Inc 07/01/2015 Navitaire LLC Amadeus IT Group SA Deal Value US$(m) 09/10/2015 Zscaler, Inc. TPG Capital LP 100 08/03/2015 Infitrak, Inc. Mesa Laboratories, Inc. 22 09/02/2015 BearWare, Inc. The Descartes Systems Group Inc 11 07/06/2015 Vega Deutschland GmbH DATAGROUP AG Not disclosed 07/29/2015 Flash Europe International S.A. Eurazeo PME Not disclosed 07/22/2015 Western Outdoor Interactive Pvt. Ltd. Global Eagle Entertainment Inc. Not disclosed 07/22/2015 Aviaso Inc. Honeywell International Inc. Not disclosed 07/31/2015 Invertag AG; Gorba AG Luminator Technology Group Quarterly Spotlights 830 Not disclosed 15 Bidder Company About ICF 1,353 Aviation and Aerospace M&A Quarterly Q3 2015

16) Quarterly Spotlight Introduction Uncle Warren’s Big Bet: Is Berkshire Hathaway’s Acquisition of PCC A Good Move? Aircraft Airlines Aerospace Kevin Michaels Vice President, ICF International In August 2015, Berkshire Hathaway announced the largest acquisition in aerospace history, a blockbuster deal to buy Precision Castparts (PCC) valued at US$37bn. Why did Warren Buffet, arguably the world’s greatest investor, make his biggest bet to date on an aerospace supplier? PCC appears to be an ideal fit for Berkshire Hathaway, which is seeking market diversification and buys wellrun companies with an investment horizon of…basically forever. PCC is the epitome of a well-run company with revenue in excess of US$10bn and a whopping 25.8% EBIT margin. It is one of a handful of aerospace suppliers with productivity embedded in its corporate DNA. Its relentless pursuit of “lean” not only underpins phenomenal earnings, but also enables a hyper-aggressive acquisition strategy. Because PCC can create more value than competing buyers, it consistently outbids them for attractive firms. It acquired eight firms in 2013 alone. PCC has created a new type of supplier by vertically integrating from 16 mill product to specialty processes to components and subassemblies. It is the chief protagonist of one of the largest trends in the aerospace supply chain: sub-tier consolidation. Today, it is one of the top two suppliers of nickel alloy, rotating-grade titanium, investment castings, forgings, fasteners and large structural castings. There is also a relatively high degree of certainty in PCC’s revenue stream. Approximately 70% of its revenue is from aerospace, which enjoys a seven-year backlog in jet transports. And it is well-positioned in new aircraft models that have a long future production horizon; its shipset value on the 787, for example, is US$10m. Another reason to like the deal is timing. Berkshire Hathaway bought PCC after its stock tumbled 20% in recent months – largely on concerns that the other 30% of its revenue derived from power generation, oil & gas and industrial markets will be negatively impacted by plunging energy prices. Surely oil prices won’t be in the $40-50/bbl range in the long run, and energy CAPEX will eventually recover. And the secular trend of power generation from coal to natural gas will benefit PCC’s industrial gas turbine portfolio. In summary: fantastic Airport Tech Quarterly Spotlights About ICF Aviation and Aerospace M&A Quarterly Q3 2015

17) earnings, a large backlog, high entry barriers, and fortuitous timing. What isn’t to like about this deal? It may be contrarian, but I have several important concerns. The first is leadership. CEO Mark Donegan, now 59, forged PCC’s unique culture and relentless drive for productivity. How much longer will he remain with PCC following the acquisition, and will the culture persist after he retires? This is the same question that bedevils Berkshire Hathaway investors who worry that the firm will lose its mojo when the 85-year old CEO Warren Buffet retires. Succession planning will be key. A second worry is supply chain counter-strategies to offset PCC’s considerable bargaining leverage as the subtier gorilla. Many OEMs are pursuing tactics to increase the leverage and/or reduce their dependence on PCC. This includes qualification of new suppliers to outright vertical integration. Recent acquisitions by Alcoa and Allegheny Technologies are creating new super suppliers to counter PCC’s dominance. Pricing pressure on large sub-tier suppliers is likely to increase as major OEMs strive to meet demanding shareholder expectations. This means that PCC will need to balance carefully its pricing power with its customers’ drive to reduce costs. Another concern is that PCC’s current focus on highly engineered metallic parts may limit its ability need to grow through acquisition. It has already scooped up many of the solid sub-tier firms in aerospace at Tier 2 and below. Where does it go from here? Should it move into major aerostructures, where suppliers 17 typically scratch out single digit profit margins? Should it expand into new downstream aerospace market segments or entirely new industries where it has less familiarity? Eventually it will need to redefine its corporate strategy as it cannot maintain its earnings growth momentum on organic expansion alone. This may be why it acquired Composite Horizons, an aerospace composite component supplier and a rare foray into the world of non-metallic products. Finally, a longer term concern is the influence of disruptive technologies on PCC’s core markets. Additive manufacturing has the potential to upend some of PCC’s key products, including investment castings, machined parts, and forgings. And GE is aggressively pursuing ceramic matrix composites, which threaten some of PCC’s profitable engine components. Even if these disruptive technologies don’t become mainstream for another decade or more, OEMs can use the threat of introducing them to enhance their bargaining leverage on the next aircraft program. These concerns aside, I believe that Berkshire Hathaway shareholders will be pleased with the PCC mega-deal in the long run. PCC’s relentless focus on productivity positions it well in what is sure be a cost-driven decade ahead for aerospace suppliers. It has time to prepare for disruptive technologies, and to groom a successor to its CEO. And energy and industrial markets will eventually recover. Aerospace insiders have long marveled at the unique Precision Castparts business model. Now, the world’s greatest investor has joined the chorus. Introduction Aircraft Airlines Aerospace Airport Tech Quarterly Spotlights About ICF Aviation and Aerospace M&A Quarterly Q3 2015

18) Quarterly Spotlight Introduction U.S. Airport Privatization to Take Off? Aircraft Airlines Aerospace Eliot Lees Vice President, ICF International Airport privatization in the U.S. has never really launched. In 1997, following the success of airport privatization in other parts of the world, the U.S. Congress established the Pilot Privatization Program to open a limited test to see how it would work in this country. It has not. Over the past 18 years, only two U.S. airports successfully navigated the privatization program and entered into long-term concessions with private airport operators: Stewart International Airport (SWF) and Jose Munoz International Airport in San Juan, Puerto Rico (SJU). Stewart went private in 1997 but reverted to the public sector in 2003 when it was purchased by the Port Authority of New York and New Jersey. San Juan was privatized in 2013 after a successful tender process. Currently Oaktree Capital and ASUR, a Mexican airport operator, are investing US$1.4bn in the airport and managing it under a 40-year concession. However, San Juan was a rather unique situation, one not likely reproducible on the U.S. mainland. The City 18 of Chicago tried twice to privatize Midway Airport (MDW) and failed both times. A few other airports have entertained the idea but never moved forward. The general consensus is that the privatization program airline approval requirements make this an unworkable option. So what is the outlook for private sector involvement (“3P” or “PPP”) going forward? The U.S. airport business model and funding of infrastructure is unlike that used by the rest of the world. The building blocks of this structure, Airline Use Agreements, FAA Airport Improvement Program (AIP) grants, Passenger Facility Charges (PFCs), and tax-exempt bond financing define how U.S. airport development has proceeded over the past four decades. However, decades of AIP underfunding have resulting in aging airport infrastructure and a mounting bill to make needed investments. At this moment, Congress is reconsidering the U.S. airport business model through a possible revamping of the 2015 AIP Reauthorization bill. The proposed new bill would strip Air Traffic Control out of AIP and drastically reduce the AIP funding pool – possibly by more than a third of present levels. If this sort of restructuring happens, U.S. Airport Tech Quarterly Spotlights About ICF Aviation and Aerospace M&A Quarterly Q3 2015

19) airports will need to consider new approaches to funding and paying for infrastructure – “U.S. Airport Privatization 2.0.” Given the realities of the U.S. market, is there another avenue for private sector participation at U.S. airports? We believe there is. While current U.S. FAA funding restrictions make it extremely difficult to cede control of entire airports, there are growing examples of private sector participation in airports – in the form of partial concessions. Individual terminals have been privately developed and operated. The unit terminal concept applied at New York JFK, Los Angeles and Boston airports saw airlines successfully develop, finance, construct and operate a number of terminals in each of those markets. This has been extended to non-airline tenants at both JFK (T4) and LaGuardia. The LaGuardia Central Terminal redevelopment project, awarded to the Vantage Consortium in June of this year, will result in a US$3.6bn 3P initiative that is a true Public Private Partnership: partially funded by the private sector (with the balance being funding by the Port Authority), privately constructed and privately operated. Another example of a partial concession is Sanford Orlando Airport (SFB), which has been controlled by a private airport operator under a 40-year terminal management lease with investment responsibilities. This may well be the future of U.S. Airport Privatization 2.0. New 3P structures, for example concessioning diverse pieces of airports to the private sector, are starting to emerge. Denver is currently engaging in a tender process to select a private operator with the responsibility to 19 redevelop and operate the Jeppesen Terminal under a long-term lease - with investment responsibilities. The City of Chicago has just issued a Request for Proposals (RfP) for a concession of the retail areas at Midway Airport, under a broad scope that includes a major terminal renovation. And Des Moines International Airport is currently exploring a terminal privatization option. If U.S. AIP is eviscerated in the manner currently being discussed in Congress – U.S. airports will increasingly be squeezed, lack funding and be unable to replace aging infrastructure needed to meet expected aviation growth. Faced with this challenge, U.S. Airport Privatization 2.0 may represent part of the solution. Introduction Aircraft Airlines Aerospace Airport Tech Quarterly Spotlights About ICF Aviation and Aerospace M&A Quarterly Q3 2015

20) About ICF ICF’s Aviation Consulting and Services business was founded as SH&E in 1963 and grew into one of the world’s largest consulting firm specializing in aviation. In 2007, SH&E was acquired by ICF, and subsequently acquired the leading aerospace consultancy AeroStrategy in 2011. Today, ICF’s aviation professionals now operate from full-service offices in Ann Arbor, New York, Boston, London, Beijing, and Singapore. Our staff of approximately 100 professionals encompasses expertise in all disciplines of the industry, and the firm has provided consulting, strategic planning, and technical services to airlines, leasing companies, government agencies, airframe and engine manufacturers, corporate flight departments, heads-of-state flight departments, and financial institutions. ICF brings clients solutions through four specialized practices, which collaborate together and with clients to address business challenges: Aerospace & MRO, Aircraft, Airlines, and Airports. In addition, ICF’s aviation professionals provides expert buy-side and sell-side commercial and operational due diligence services to corporate clients, private equity firms, and other institutional investors with respect to investments across the entirety of the aviation ecosystem. 20 Introduction A more complete description of ICF’s aviation experience and capabilities can be seen by visiting our web site, www.icfi.com/aviation Aircraft Airlines Aerospace ICF International ICF International (NASDAQ:ICFI) provides professional services and technology solutions that deliver beneficial impact in areas critical to the world’s future. ICF is fluent in the language of change, whether driven by markets, technology, or policy. Since 1969, we have combined a passion for our work with deep industry expertise to tackle our clients’ most important challenges. We partner with clients around the globe— advising, executing, innovating—to help them define and achieve success. Our more than 5,000 employees serve government and commercial clients from more than 70 offices worldwide. Contact: Eliot Lees Head of Transaction Advisory – Aviation & Aerospace ICF International 100 Cambridgepark Drive, Suite 501 Cambridge, MA, 02140 USA Eliot.Lees@icfi.com | +1 617 218 3540 Airport Tech Quarterly Spotlights About ICF Aviation and Aerospace M&A Quarterly Q3 2015

21) ICF International has more than 70 locations worldwide, including offices in: The Americas New York 630 Third Avenue, 11th Floor New York, NY 10017 USA Tel: +1 212 656 9200 Washington 9300 Lee Highway Fairfax, VA 22031 USA Tel: +1 703 934 3000 Boston 100 Cambridgepark Drive, Suite 501 Cambridge, MA 02140, USA Tel: +1 617 218 3500 Ann Arbor 101 North Main Street, Suite 400 Ann Arbor, MI 48104 USA Tel: +1 734 786 5276 21 Europe, Middle East, Africa London 6th Floor, Watling House 33 Cannon Street, London United Kingdom EC4M 5SB Tel: +44 20 7242 9333 Asia-Pacific Beijing China Overseas Plaza Tower 2, Suite 2001, 8 Guanghua Dongli Chaoyang, Beijing, 100020 China 北京æœé˜³åŒºå…‰åŽä¸œé‡Œ8å·ä¸æµ·å¹¿åœº2 å·æ¥¼2001,邮编 100020 T ç”µè¯ +86 10 65628305 Introduction Aircraft Airlines Aerospace Airport Tech Quarterly Spotlights About ICF Hong Kong 19/F, Heng Shan Centre, 145 Queen’s Road East, Wan Chai, Hong Kong Tel: +852 2868 6980 Singapore 314 Tanglin Road # 01-05 Phoenix Park Office Campus Singapore 247977 Tel: +65 6884 4951 Aviation and Aerospace M&A Quarterly Q3 2015