Severity: Notice

Message: Undefined variable: content_category

Filename: user/transcript.php

Line Number: 106

Severity: Warning

Message: Invalid argument supplied for foreach()

Filename: user/transcript.php

Line Number: 106

1) ReedSmith The business of relationships.SM FinTech Report: Summary of Responses to Treasury RFI on Marketplace Lending January 14, 2016 David S. Reidy Nicholas F.B. Smyth Heather Cantua Phillips and Tyler M. Layton Editorial Team: Drew Amoroso, Roxanne Anderson, Sean Donoghue, Anthony Ford, Yvonne Pham, Rachel Naor, Jaclyn Schwizer, Jamie Wells, and Molly Zapala. AM US_ACTIVE-125155318.5-HCPHILLI 01/14/2016 9:01

2) ReedSmith Table of Contents ..................................................................... page I. Introduction..................................................................................................................................... 1 II. Treasury’s RFI on Marketplace Lending ......................................................................................... 4 III. Summary of Responses to the Treasury RFI ........................................................................... 6 A. Business Models ...................................................................................................................... 6 B. Expanding Access to Underserved Market Segments ............................................................. 8 (1) Small Business Lending ....................................................................................................... 8 (2) Underbanked Consumers ................................................................................................... 10 (3) Micro-Lending ..................................................................................................................... 12 C. Potential Changes to the Financial Regulatory Framework ................................................... 13 (1) (2) A Federal Charter for Online Lenders ................................................................................. 16 (3) A New British Invasion…? .................................................................................................. 17 (4) Other US Tax Reform ......................................................................................................... 17 (5) Small Business Borrower’s Bill of Rights ............................................................................ 18 (6) Data Privacy Protection ...................................................................................................... 19 (7) IV. Addressing State Laws and Judicial Rulings ...................................................................... 14 Reforms of the Secondary Market ...................................................................................... 19 Conclusion ............................................................................................................................. 21 APPENDIX A The Reed Smith Team APPENDIX B Treasury’s RFI APPENDIX C List of Comments in Response to RFI APPENDIX D Madden v. Midland, Case No. 14-2131 (2nd Cir., May 22, 2015) reedsmith.com i

3) ReedSmith I. Introduction On July 20, 2015, the US Department of the Treasury issued a Request for Information entitled “Public Input on Expanding Access to Credit through Online Marketplace Lending” (the “Treasury RFI”).1 Just fewer than 100 comments were submitted by marketplace lenders and other FinTech companies, as well as banks, industry and consumer groups, politicians, agencies and other concerned parties. This report provides an overview of the substance of those responses, and a summary of their key themes and new ideas. The RFI poses numerous questions to industry participants, but its issuance by the Treasury Department raises its own questions: Why did Treasury put out the RFI? What will Treasury do with the comments it receives? After all, Treasury is not a regulator. If the Securities and Exchange Commission (SEC) or Consumer Financial Protection Bureau (CFPB) had released a similar RFI, for example, the purpose and potential resulting regulatory action might have been easier to predict. But Treasury’s role suggests a broader policy initiative than might be expected had the RFI been issued by a pure industry regulator. Based on the office that issued the RFI, we believe Treasury’s primary goal in releasing the RFI is to encourage marketplace 1 80 FR 42866. lenders to continue expanding credit to small businesses. The RFI cites a 2015 Federal Reserve Survey that found that “a majority of small firms (under $1 million in annual revenues) and startups (under 5 years in business) were unable to secure any credit in the prior year.”2 Treasury clearly wants to encourage large and small lenders to increase the availability of credit by using “technology-enabled credit provisioning,” which Treasury says “offers the potential to reduce transaction costs.”3 With Congress at a stand-still, the Obama administration has made clear that it will pursue policies through executive actions, and it may be that the RFI is a first step in developing executive actions to encourage such lending without relying on action from Congress. The RFI was released by Treasury’s Office of Small Business, Community Development, and Housing (part of the Office of Financial Institutions, within the Office of the Undersecretary for Domestic Finance), and responses were directed to Laura Temel, a Policy Advisor in that office. According to public sources, Temel is a successful entrepreneur who has founded two companies, one of which was selected to participate in the inaugural class of the Nike+ Accelerator. Previously, she was an 2 See Appendix A, Treasury RFI, p. 5 (citing “The Joint Small Business Credit Survey, 2014,” a collaboration among the Federal Reserve Banks of New York, Atlanta, Cleveland and Philadelphia. Released February 2015. ). 3 Id., p. 6. Page 1 of 22

4) ReedSmith investment banker. Treasury’s choice to lead the RFI underscores the business focus of the project. The Small Business Office is a policymaking office; its mission is to coordinate “policy on the following areas: small business finance and development; housing policy; community and economic development; capital access; and issues related to underserved communities.”4 The Office also oversees the Small Business Lending Fund and the State Small Business Credit Initiative. This office is small but influential; its alumni include, among others, Don Graves (now Deputy Assistant to the President and Counselor to the Vice President) and Sameera Fazili (now senior visiting adviser to the Federal Reserve Bank of Atlanta’s community and economic development group, formerly senior policy adviser at the White House’s National Economic Council). Given the responsibilities of the Small Business Office and the entrepreneurial background of the Treasury official who is behind the RFI, it seems clear that learning how the government and marketplace lenders can work together to further improve small business credit access, cost, and speed is the primary focus of the RFI. However, it likely is not the only focus. 4 https://www.treasury.gov/about/organizationalstructure/offices/Pages/Sm-Business-CommunityDev-Housing-Policy.aspx A secondary purpose of the RFI may be to enhance the public conversation with respect to the potential benefits and risks of marketplace lending. Treasury no doubt recognizes that in an industry that is evolving as rapidly as marketplace lending, it would be helpful to have a public repository of data and analysis from industry actors, consumer advocates, and others. This will provide the CFPB or SEC with a helpful baseline in the event that one of those agencies decides to promulgate rules to reduce the potential risks of or otherwise encourage marketplace lending. Although we have no reason to expect that new SEC or CFPB rules are imminent,5 those agencies nonetheless are focused on FinTech and will be interested in the industry responses. The combined 1,000 pages of comments submitted in response to the RFI provide a unique insight into the development of online lending, as well as a range of proposals and suggestions for its future growth and regulation. Thus far, the only comment from Treasury that discusses the responses to the RFI is an October 2015 speech by Antonio Weiss, Counselor to the Secretary. His remarks support our conclusions above: 5 The CFPB is currently working on a proposed rule that will significantly change the market for online and brick and mortar payday lending, auto title lending, and high-cost installment lending, but the Treasury RFI explicitly excluded these types of loans – to the extent they are made by marketplace lenders – from the scope of the RFI. Treasury RFI, p. 1. Page 2 of 22

5) ReedSmith At Treasury, we will seek to foster, not impede, innovation that increases competition and broadens access to affordable credit for creditworthy borrowers and businesses. But we will also be vigilant in ensuring that innovation does not undermine important privacy and consumer protection priorities.6 We expect Treasury may soon release a white paper that summarizes the responses and possibly makes recommendations for executive actions or regulatory or legislative changes to encourage additional small business lending. Although Treasury cannot write rules or enact statutes itself, it can recommend actions for the White House to implement through executive order or other executive actions. In addition, a future Congress or other agency might be persuaded by a well-researched and carefully reasoned report from Treasury’s Small Business Office. As we await Treasury’s report, Reed Smith’s FinTech Team thought it would be helpful to sit down and read the RFI responses, and to provide our own report on the themes, arguments and proposals contained in their pages. We hope you find it as interesting to read as it was to write! 6 available at : https://www.treasury.gov/presscenter/press-releases/Pages/jl0238.aspx Page 3 of 22

6) ReedSmith II. that might allow making loans to non-prime borrowers at lower rates.7 Treasury’s RFI on Marketplace Lending With respect to small businesses, a number of studies have shown that these borrowers are more dependent on community banks for financing than larger firms. . . . Small business lending, however, has high search, transaction, and underwriting costs for banks relative to potential revenue – it costs about the same to underwrite a $5 million dollar loan as a $200,000 loan8 – and many small business owners report they are unable to access the credit needed to grow their business. . . . More than half of small businesses that applied for credit in 2014 sought loans of $100,000 or less. . . . Technologyenabled credit provisioning offers the potential to reduce transaction costs for these products, while investment capital may offer a new source of financing for historically underserved markets. The Treasury RFI begins with a 5-page introduction, which we have abridged here: The Treasury Department is seeking public comment through this Request For Information (RFI) on (i) the various business models of and products offered by online marketplace lenders to small businesses and consumers; (ii) the potential for online marketplace lending to expand access to credit to historically underserved market segments; and (iii) how the financial regulatory framework should evolve to support the safe growth of this industry. . . . We also seek any additional information beyond these questions that market participants believe would assist in our efforts to become better informed of the impact of online marketplace lending on small businesses, consumers, and the broader economy. Historically, many American households, small businesses, and promising new enterprises have faced barriers in accessing affordable credit from traditional lenders. To date, the large majority of online marketplace consumer loans have been originated to prime or near- prime consumers to refinance existing debt. . . . Some online marketplace lenders, however, are developing product structures and underwriting models Online marketplace lending . . . initially emerged with companies giving investors the ability to provide financing that would be used to fund individual borrowers through what became known as a “peer-to-peer” model. However, it has since evolved to include a diverse set of 7 As noted elsewhere, the CFPB is contemplating issuing a rule that would regulate “payday” and related loans, including loans with terms greater than 45 days and an APR greater than 36%, if the loan also provides for repayment directly from a consumer’s account or paycheck or includes a nonpurchase money security interest in a vehicle. Such consumer loans are outside the scope of this RFI. 8 “The Future of Finance,” Goldman Sachs Equity Research, March 3, 2015. Page 4 of 22

7) ReedSmith individual and institutional credit investors who seek to provide financing that ultimately is used to fund small business and consumer loans of various types to gain access to additional credit channels and favorable rates of return. Treasury posed 14 “Key Questions” (closer to 40 questions counting subparts) that explore the three big topic areas framed by the RFI: business models, expanding access to credit, and potential regulatory evolution. We have synthesized some of the main comments submitted in response to the RFI. Page 5 of 22

8) ReedSmith Summary of Responses to the Treasury RFI A. ï‚· Bank-Affiliated lenders – banks originate and hold, distribute and/or return loans to the marketplace lenders; and ï‚· III. Bank-Partnership – many marketplace lenders utilize a bank partnership model, either in whole or in part, in which loans are funded by a bank and sold to an investor or to the marketplace lender. Business Models Three of Treasury’s questions focus on the marketplace business models and products. See RFI Question 1, 5, and 7. These questions asked: ï‚· How policymakers should be thinking about different business models and market segmentation; ï‚· What kinds of marketing channels are used to reach new customers; and ï‚· How marketplace lending relies on services or relationships provided by traditional lending institutions or insured depository institutions. In its comment, the Conference of State Bank Supervisors provides a helpful overview of the marketplace lending business models, organized on the basis of funding sources:9 ï‚· Balance Sheet Lenders –lenders that originate loans and retain credit risk in their own portfolios; ï‚· Online Platforms (peer-to-peer) – platform lenders utilize a pass-through securitization structure where loans are immediately sold to investors, and retain the credit risk and provide funding; Many comments acknowledge that automation and technology have lowered the operating cost of online lenders, thereby increasing the likelihood that more customers can be served.10 The Online Lenders Alliance (OLA), responding on behalf of “the growing industry of online companies offering consumers small-dollar, short-term loans,” argues that banks have been slow to adapt to “rapid changes in technology,” and that marketplace lenders have been able to “disrupt the traditional lending industry in a very short period of time.”11 Nonetheless, as the list above illustrates, many marketplace lenders work with the banks cooperatively. For example, Affirm, Inc., provides point-of-sale financing to consumers through a partnership with a state-chartered bank, and states that this partnership gives the company the benefit of being able to “export its home-state’s interest rate on loans.”12 Many other platform lenders similarly acknowledge these bank partnerships, and indeed this 9 See Conference of State Bank Supervisors (CSBS), p. 2. Readers are encouraged to review the comment letters and the myriad primary source materials that the letters cite. We do not cite any of the primary sources here. 10 See e.g., Kabbage, p. 2. 11 OLA, pp. 1, 3. 12 See Affirm, p. 2-3. Page 6 of 22

9) ReedSmith tension between competition and cooperation has, inevitably, gained a label: “coopetition.” “Coopetition” Several comments discussed the notion of “coopetition” between traditional banks and marketplace lenders. GLI Finance, an investment company, emphasized the cooperative nature of the relationship since traditional banks are “a source of capital, a repository for funds, and a source of new customers.”13 Godolphin Capital Management noted that “[s]everal platforms have entered into alliances with banks and other institutions such as accounting software providers to both provide leads as well as ‘white-label’ the intellectual property on behalf of these institutions. This “coopetition” model is likely to grow further as smaller regional banks can use marketplace lending platforms with a national footprint to diversify both regionally and across asset classes.”14 The bank partnership model has proven attractive to bigger players like Lending Club and Prosper. However, it has not been a good fit for some small-dollar lenders because of issues that come with a bank charter. According to Opportun, a marketplace lender that targets the Hispanic market, “prudential regulation and legal risk management often create profitability challenges when considering the traditionally underserved consumer’s need for non-traditional underwriting and 13 14 credit models, and a retail-based channel option.”15 Other comments view the industry business models in terms of the different markets served by marketplace lending products. PeerIQ, an information services company, describes the business models as differentiated primarily by: ï‚· Market segments (i.e.) consumer, small business, commercial loans; ï‚· Products (e.g.) installment loans, lines of credit, merchant cash advances; ï‚· Origination channels (e.g.) direct mail, online, partner affiliate, branch, and paid search; ï‚· Credit risk (i.e.) prime, near-prime, subprime, thin-file; ï‚· Funding mechanisms (i.e.) balance sheet, marketplace, hybrid, bankaffiliated16 PeerIQ goes on to point out the “diversity of value propositions and business models” in each borrower segment: “. . . Lending Club has established partnerships with data companies to improve customer acquisition and underwriting. Prosper has recently acquired a spending-and-tracking app company, to improve customer engagement. Lenddo is using social media criteria to assess creditworthiness. Upstart factors in education and experience in determining creditworthiness for thin- GLI Finance, p. 3. 15 Opportun, p. 13. Godolphin, pp. 2-3. 16 PeerIQ, p. 2. Page 7 of 22

10) ReedSmith has completed an investment-grade small business loan securitization in which it retained a 5% first loss risk position.20 file borrowers. Affirm is creating speedy point-of-sale algorithms as an alternative to credit cards. As for small business lending, PayPal is relying on its merchant payment data to extend credit to small business; Amazon offers lending services to “help sellers grow”; and Dealstruck provides lending tools for the midprime market, which includes [small and midsize businesses] who are not eligible for traditional bank financing.”17 Another example of coopetition is offered by Income& Technologies, Inc., a marketplace lending platform focusing on high credit-quality 1-4 family residential mortgages that do not meet the definition of a Qualified Mortgage. Income& does not originate loans but partners with institutions originating high-quality non-QM mortgages (mostly small banks and credit unions) and sells investors the cash flow from those mortgages with the goal of expanding available credit for the small banks and credit unions to make more loans.18 OnDeck, a marketplace lender focused on small business lending, relies on a diversified model that includes large bank credit facilities “which allow OnDeck to hold the majority of our loans on our balance sheet” and to “retain the first loss position” on those facilities.19 The company also sells whole loans to institutional investors, and it The collective comments on the industry business models therefore create a more nuanced picture than the “fintech v. banks” headlines sometimes suggest. Many commenters, and Treasury itself, recognize that marketplace lending—and technology generally—provides a promising array of tools with which to provide access to credit in underserved markets. This broad policy goal is at the heart of the RFI, and addresses challenges faced specifically by small businesses and the underbanked. B. Expanding Access to Underserved Market Segments (1) Small Business Lending In its RFI, Treasury states that while many small businesses rely on community banks for financing, small business lending has “high search, transaction, and underwriting costs” that make it difficult for banks to serve small business needs in a profitable way—noting that “it costs about the same to underwrite a $5 million dollar loan as a $200,000 loan.21 The RFI recognizes that “technology-enabled credit provisioning offers the potential to reduce transaction costs for these products, while investment 17 Id., p.4 (footnotes and citations omitted). 20 18 Income&, p. 2. 21 19 OnDeck, p. 5. Id. Treasury RFI, p. 5, citing “The Future of Finance,” Goldman Sachs Equity Research, March 3, 2015. Page 8 of 22

11) ReedSmith capital may offer a new source of financing for historically underserved markets,” and notes that the “2014 Small Business Credit Survey indicated that almost 20 percent of applicants sought credit from an online lender.”22 Many commenters agreed, observing that large financial institutions operate within a cost structure that may preclude them from making loans below a certain size to small businesses. Kabbage comments that big banks arguably could benefit from deploying the technologies utilized by marketplace lenders, and that policymakers therefore may want to investigate ways to encourage collaboration between banks and new lenders that possess such technologies.23 LendingTree, a marketplace of online lenders, states that FinTech is filling an important need particularly for small business owners. In a survey conducted by LendingTree in February through March of 2015 (involving 155 small business owners who had applied for loans within the past year), the most frequently cited struggles were: (i) gathering required documentation; (ii) long application process; and (iii) speed of approval.24 22 23 24 RFI, p. 6. See Kabbage, pp. 1, 6. LendingTree, p. 3. LendingTree claims that increased automation will alleviate these issues, allowing for faster application-to-funding cycles without an inherent reduction in underwriting quality or consumer protection: In turn, borrowers who are able to experience more efficient application processes are more likely to have access to credit when they need it, and less likely to abandon the credit markets due to burdensome processes that leave them discouraged with their chances of obtaining funding.25 Marketplace lenders in the small business space claim to provide better matching between a loan term and expected payback: for example, a higher-interest rate short term loan may end up costing less in total interest and fees than a lower-interest loan with a longer term.26 Many other FinTech companies voiced a similar need being fulfilled by FinTech. OnDeck claims that by offering loans with shorter terms, it can decrease credit risk and provide capital to “otherwise nonbankable small businesses,” with repayments structured on a daily or weekly basis.27 OnDeck has made more than $3 billion in loans to small businesses to date, and it cites post-financial crisis data that shows only 36% of small business borrowers have been able to get all the 25 Id. 26 See OnDeck, p. 3. 27 OnDeck, p. 4. Page 9 of 22

12) ReedSmith financing they sought, leaving $80-$120 billion in unmet demand for small business lines of credit.28 A series of RFI questions focused on the theme of expanding access to credit to historically underserved market segments.29 Many of the comments in response take the position that FinTech companies are serving the underbanked consumer market despite the fact that, as the RFI points out, most online lending to date has been to “prime or near-prime consumers to refinance existing debt.” In its comment, LendAcademy lists several lending platforms focused on expanding access to consumer credit: ï‚· Upstart is a lender focused on young people with a good education who are starting out and have little or no credit history. ï‚· Avant targets the “middle class” borrower who has fewer options than prime borrowers. ï‚· Freedom Financial works with borrowers who have experienced financial distress, a group that many platforms ignore. ï‚· Opportun, formerly Progresso Financiero, targets the Hispanic market, a market that has historically been underserved. ï‚· LendUp helps sub-prime borrowers transition from payday lending through Id., pp. 1, 2, 5. 29 See RFI Questions 2, 3, 4, and 6. ï‚· Lenddo is working to establishing an alternative credit scoring system for people without a credit score. ï‚· (2) Underbanked Consumers 28 education and a system designed to improve borrowers’ credit scores. Kiva Zip is an impact investment platform to help customers and brand ambassadors support their local business.30 Indeed, because both traditional lenders and many larger marketplace lenders rely on a minimum FICO score, marketplace lenders such as Opportun who are focused on small-dollar lending to traditionally underserved communities state that “many of the 64 million credit-eligible borrowers who are unscoreable or have no or thin files, living in the US are automatically excluded from qualifying for most online marketplace loan pools.”31 Opportun focuses on the “25 million unbanked or underbanked Hispanic individuals” in the US, a customer base with an average income of $32,100 per year, and an average loan amount of $2,000,32 and targets these customers by relying on alternative data sources—such as utility information, transactional data, or bank account information—to “score” potential borrowers; Opportun also provides documentation in Spanish and English, as well as mobile phone access33, physical 30 See Lend Academy, p. 13. 31 Opportun, p. 3. 32 Id., pp. 1, 7. 33 Opportun cites a Federal Reserve study that found that 82% of Hispanic mobile phone users have a smartphone, compared to 68% of nonPage 10 of 22

13) ReedSmith locations in the communities it serves, and cash repayment options to serve its customers.34 Opportun and others cite an array of statistics on the underbanked in America, including: one in thirteen US households remains unbanked; an additional 20 percent of American households are “underbanked—meaning that they rely upon alternative financial services outside of the banking system to fully meet their financial needs”; and 25% of credit-eligible consumer in the US have little or no history at the three major US credit reporting agencies. Id. Although many comments point out that Prosper and Lending Club cater primarily to borrowers with good credit, for its part Lending Club states that in 2015 it expanded its platform’s reach to low- and moderate-income individuals through partnerships with Citi bank and Varadero Capital, “designed to deliver $150mm of affordable credit to underserved, low- to moderate- income borrowers.”35 New Jersey-based Cross River Bank’s comment reinforces the argument that online lenders are expanding the credit box: “Marketplace lenders are able to develop models which they find to be more effective at predicting credit outcomes than traditional scoring models, such as FICO based models. These enhanced scoring models enable marketplace lenders to make loans to borrowers who would not receive credit under traditional market standards, but are demonstrated to be worthwhile credits when considering additional information.”36 Affirm emphasizes that its online point-ofsale loans are widely available and that its services are utilized by borrowers who may be turned down by other lenders. “Affirm’s loans span the spectrum of credit worthiness from subprime to super prime.”37 Affirm believes that broad access to its services benefits both its banking partner (Cross River Bank), as well as traditionally underserved borrowers. “By lending to consumers across the credit spectrum, 35 Hispanic white and 66 percent of non-Hispanic black phone users. See Opportun, p. 15. 34 Opportun, p. 3, 8. Lending Club, p. 14. Low- to moderate income individuals are defined in the comment as those with reported adjusted household income less than 80% of the median income of their zip code and live in majority or greater low to moderate income census tracts as of June 30, 2015. Lending Club, p. 14, fn. 9. 36 Cross River Bank, p. 4. 37 Affirm, p. 1. Page 11 of 22

14) ReedSmith Affirm has a more diverse credit and risk portfolio. Most importantly, its products can be used by all consumers and small businesses.”38 Like Affirm, Upstart partners with Cross River Bank to offer online loans. Both Affirm and Upstart say that they leverage innovative technology to underwrite their loans, which results in credit being extended to borrowers who may be rejected under traditional underwriting techniques.39 For example, Affirm uses technology to survey an applicant’s liquidity, which Affirm believes gives it a more accurate picture of the applicant’s creditworthiness than a credit score alone. Affirm believes that its “dynamic credit” model, which places insular negative credit events in a larger context of a borrower’s overall creditworthiness, will increase consumers’ access to credit, and that “traditionally noncredit worthy consumers may actually be offered credit to assist with improving their financial well-being.”40 Upstart similarly points out that “[b]y complementing (not replacing) traditional underwriting factors with factors that are correlated with financial capacity and propensity to repay, the [Upstart] underwriting model better understands and quantifies risk associated with all borrowers – those with credit history, and those without.”41 In its comment, credit bureau Equifax notes that the borrower may be additionally protected by better income verification: “Another industry best practice for assessing a consumer’s ability to repay is the use of employer payroll information to verify a consumer’s income, which is more accurate than consumer stated income.”42 The Center for Financial Services Innovation (CFSI) believes that “online marketplace lenders may continue to move down the credit spectrum,” which would be more beneficial to underserved consumers than alternatives such as payday lending.43 CFSI believes, however, that “the online marketplace lending environment has not yet reached its full potential in serving underserved consumer segments” because most marketplace lenders do not offer small loans.44 Thus, when consumers with lower credit scores or those who want to borrow smaller amounts go online, they are still pushed to payday or high-cost installment lenders.45 (3) An example of a lender focused on very small dollar loans is Kiva, a nonprofit 41 Id. 42 38 39 40 Micro-Lending Equifax, p. 3. Id., p. 4. 43 CFSI, p. 3. See, e.g., Upstart, p. 2. 44 Id., p. 4 Affirm, p. 6. 45 Id. Page 12 of 22

15) ReedSmith organization that allows individuals to fund microloans to borrowers both in the United States and internationally, in increments as small as $25 per lender. Unlike most online marketplace lenders, Kiva does not charge any interest or fees to borrowers and does not allow its users to earn a return on their loans. Users make credit decisions based on “social underwriting” including: the borrower’s online presence, endorsements by local community members, and a detailed loan profile.46 When Kiva first launched its direct lending program, it set aside a small amount of its own funds to lend in case users did not fund the available loans. Interestingly, the loans the crowd chose not to fully fund, and which were therefore partially funded by Kiva, proved to have a higher default rate than those loans that were funded entirely by the crowd.47 C. Potential Changes to the Financial Regulatory Framework The RFI questions what role the federal government might play to facilitate positive innovation in lending.48 Many commenters responded that due to partnerships with federally chartered banks, many of the FinTech products effectively are issued by federally regulated banks and are therefore subject to the same regulatory protection as other products provided to traditional bank customers.49 Thus, these commenters did not see an immediate need for new regulation at the federal level. Another common theme was that, given that the marketplace lending industry is still developing, trying to impose broad regulations at this juncture in the industry’s maturity could either unintentionally stifle growth or harm both borrowers and investors.50 OnDeck, for example, expressed the view that the “current environment for commercial lenders is conducive to continued innovation” and that it would be “premature and potentially harmful to small business owners if additional regulation were imposed to codify particular lending models or credit products at this early-stage of industry development.”51 WebBank, a Utah-chartered industrial bank located in Salt Lake City, agrees. WebBank, which originates a significant percentage of online marketplace loans, maintains that “from a regulatory perspective, the origination of loans through marketplace platforms does not break new ground” and that online marketplace lenders “are [already] subject to the same legal requirements and borrower protections as other loans.”52 To the extent regulatory changes were suggested by commenters, however, we 49 46 47 48 See, e.g., Lending Club, p. 4. Kiva Microfunds, pp. 3-4. 50 See, e.g., KPMG, p. 11. Kiva Microfunds, p. 4. 51 OnDeck, p. 9. See RFI 9, 10, 11. 52 WebBank, p. 1. Page 13 of 22

16) ReedSmith have tried here to group those proposals and viewpoints into loose categories: Madden Madness… (1) Addressing State Laws and Judicial Rulings Beyond the regulatory regime applicable to banks, a number of comments expressed the view that marketplace lenders are not only subject to significant state and federal laws, but that many state laws are inconsistent. Many lament the patchwork of state licensing and consumer protection laws for example—including varying interest rate caps and usury laws, different origination and servicing practices and disclosure requirements, and restrictions on advertising—that apply to marketplace lenders not following the bank partnership model.53 The comments also contain much discussion about the Second Circuit’s recent decision in Madden v. Midland Funding: 54 In Madden v. Midland Funding, the Second Circuit held that when a national bank sold a loan portfolio to a debt buyer, the purchaser could not avail of the preemptive powers of the National Bank Act and therefore lost the ability to apply the bank’s home state interest rate. Many have criticized the decision, calling it “another drag on marketplace lenders”55 and arguing that the decision ignores the “valid when made” doctrine—which states that a loan that does not violate state usury laws when made, remains valid when transferred or sold to a party in another state. The parties have filed a petition for the case to be heard by the United States Supreme Court. Affirm also addresses the patchwork quality of the current regulatory landscape in its comment: “[O]nline marketplace lenders have varying degrees of regulation, which is largely dependent on what type of funding the marketplace lender uses… [s]ome must adhere to the regulatory regime of each state in which they lend while others must adhere to the regulatory regime of the home state of their bank affiliated partner.”56 Similarly, Upstart claims that the current regulatory regime subjects marketplace lenders to “overlapping regulation.”57 “As a result [] multiple layers of compliance oversight apply to marketplace lending activities.”58 55 53 54 See Appendix C, Madden v. Midland Funding, Case No. 14-2131 (2nd Cir., May 22, 2015). Affirm, p. 7. 57 See e.g., Opportun, p. 12; Orchard Platform, p. 7. OLA, p. 8. 56 Upstart, p. 3. 58 Id. Page 14 of 22

17) ReedSmith As a solution to the “uneven regulatory landscape”, Affirm suggests that“[t]he federal government could substantially level the playing field among marketplace lenders by imposing a single federal regulatory agency that supervises and enforces federal law as it relates to marketplace lending.”59 Perhaps not surprisingly, the state regulators are generally opposed to any efforts to preempt state laws. The Conference of State Bank Supervisors (CSBS) writes that “state regulators urge Treasury to support policies that improve the efficiency of existing licensing regimes and promote protection without undermining the states’ ability to regulate and promote consumer protection entities that make loans to the citizens within their borders.”60 At the same time, many commenters agreed that to the extent marketplace lenders already are subject to existing regulations, more regulation is not what is needed—if anything, regulations need to be updated to reflect the modern economy and industry realities. OnDeck argues, for example, that the existing landscape of federal and state laws was “created at a time that did not contemplate our modern Internet economy, and therefore includes a number of archaic inefficiencies.”61 OnDeck writes that 59 60 61 policymakers should create cross-agency FinTech working groups that can engage with industry and streamline and harmonize existing laws.62 Indeed, the comments address a number of regulatory schemes enacted prior to the development of today’s internet and mobile-phone economy. Opportun cites the ESIGN Act, for example, which requires that, prior to consenting to the use of an electronic record, a consumer must be provided with a statement of the hardware and software requirements for access to such electronic records. While the regulation may have been relevant to desktop computer users in the past, “it is unclear how much information a lender needs to provide to ensure that a consumer is able to access and retain an electronic record via mobile device.”63 Some commenters want to revamp the Electronic Fund Transfer Act (EFTA) and Reg. E, arguing the law is outdated based on today’s access and convenience to electronically access payments; the National Consumer Law Center (NCLC), a consumer advocacy non-profit disagrees, however, arguing that the “EFTA ban on compulsory electronic repayments is an important protection that helps consumers to maintain control over their bank accounts.64 Affirm, p. 7. 62 Id., pp. 10-11 CSBS, p. 8. 63 Opportun, p. 15. OnDeck, p. 10. 64 NCLC, p. 5. Page 15 of 22

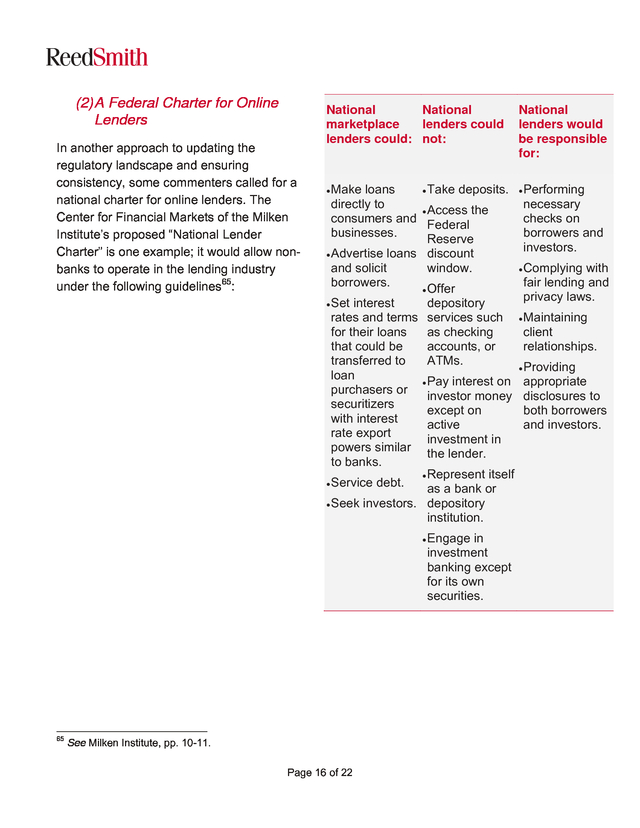

18) ReedSmith (2) A Federal Charter for Online Lenders In another approach to updating the regulatory landscape and ensuring consistency, some commenters called for a national charter for online lenders. The Center for Financial Markets of the Milken Institute’s proposed “National Lender Charter” is one example; it would allow nonbanks to operate in the lending industry under the following guidelines65: National National marketplace lenders could lenders could: not: National lenders would be responsible for: ï‚· Make ï‚· Performing loans directly to consumers and businesses. ï‚· Take deposits. ï‚· Access the Federal Reserve ï‚· Advertise loans discount and solicit window. borrowers. ï‚· Offer ï‚· Set interest rates and terms for their loans that could be transferred to loan purchasers or securitizers with interest rate export powers similar to banks. depository services such as checking accounts, or ATMs. ï‚· Pay interest on investor money except on active investment in the lender. itself as a bank or ï‚· Seek investors. depository institution. ï‚· Service debt. ï‚· Represent ï‚· Engage in investment banking except for its own securities. 65 See Milken Institute, pp. 10-11. Page 16 of 22 necessary checks on borrowers and investors. ï‚· Complying with fair lending and privacy laws. ï‚· Maintaining client relationships. ï‚· Providing appropriate disclosures to both borrowers and investors.

19) ReedSmith (3) A New British Invasion…? Some commenters lauded the regulatory approaches to marketplace lending in the UK, and suggested adopting some here in the US: Referral Network – OnDeck notes that the British government supports a referral network between banks and marketplace lenders. “The UK government has recognized the significant benefit this will provide to small businesses and has accordingly implemented measures to increase decline referrals.”66 Orchard Platform also cites the U.K.’s Financial Conduct Authority’s (FCA) “light touch approach” to regulating marketplace lending.67 After taking control of the regulation of marketplace lending, the FCA stated in February 2015 that “we see no need to change our regulatory approach to crowdfunding, either to strengthen consumer protections or to relax the requirements that apply to firms.”68 Government and Technology Platform Initiatives – the US government has access to small business data, for example at the IRS, and some commenters argue that the government should make that data available where the customer consents in order to facilitate small business lending and fraud detection and prevention. “A similar initiative is already underway in the (4) Other US Tax Reform Lending Club’s response to the RFI contains specific recommendations on how the federal government can help facilitate the safe growth of the marketplace lending industry, specifically through revisions to the tax code and collection process. First, Lending Club recommends automating the process by which tax return OnDeck, p. 10. 70 Id. Orchard Platform, pp. 7-8. 71 Lending Club, p. 29 Id., p. 8 72 OnDeck, p. 10; see also Lend Academy, pp. 1819. 68 Tax Free Investment Savings Accounts – Lending Club suggests that the US government should emulate a program in the U.K., in which investors are able to invest in “P2P loans” tax-free though an Investment Savings Account (ISA) called an Innovative Finance ISA, or “IFI”.71 Investors can deposit up to £15,240 per year (standard for ISAs), or transfer in money from other ISAs. Unlike a US IRA, there is not a tax penalty for withdrawing before retirement. Lending Club suggests that “[t]he proposed US marketplace investing incentive could similarly attract investment in underserved consumers in the same geographies, and in small businesses nationwide.”72 69 66 67 UK” OnDeck says,69 and suggests that marketplace platforms and technologies could help “government agencies deploy funds to small businesses in the aftermath of natural disasters or emergencies.”70 Id. Page 17 of 22

20) ReedSmith data is shared, thereby enabling lenders to lower cost and improve access to credit across consumer and small business borrowers.73 Currently, the IRS allows taxpayers to request a summary transcript of their filed tax returns to be provided to a third party – but processing these 4506T forms is manual and can take 2-8 days.74 As lending is increasingly structured around providing applicants with instant loan offers online, this delay prevents the use of tax data in credit models that price and approve loan applications instantaneously.75 Second, the federal government could facilitate an increase in investment and economic growth in underserved communities and certain economic sectors by creating incentives in the tax code that parallel existing tax programs.76 For example, currently, investors only have the ability to offset charge-offs against capital gains.77 To encourage investment in underserved areas, Lending Club proposes “that investors who provide capital in defined underserved areas and to low- to moderate-income small businesses borrowers be taxed at the capital gains tax rate, rather than the current marginal income tax rate, if the loan is held for over 73 74 75 12 months.”78 To encourage investment and saving, Lending Club proposes that investors in marketplace loans have “the ability to offset losses and charge-offs against interest income and gains and earn tax-free returns” against a certain dollar amount.79 Finally, for ease of operation and to lower costs, Lending Club proposes government regulations allowing “online marketplace companies to make the default delivery method of tax forms electronic,” rather than paper copies, as is required by current regulations.80 Other commenters likewise supported providing access to federal tax return information to help small-dollar loan customers who may have difficulty retrieving paper copies of income or residential information.81 (5) Small Business Borrower’s Bill of Rights Many commenters cited the Small Business Borrower’s Bill of Rights as a potential guideline for regulation.82 The Small Business Borrower’s Bill of Rights is a consensus on responsible small business lending practices assembled by a coalition of lenders, marketplaces, and brokers.83 Lending Club, p. 28. 78 Id. 79 Id. 80 Id., p. 30 81 Opportun, p. 14. 76 Id. Id. One such program is the Treasury Department’s New Markets Tax Credit program, which attracts investment in commercial real estate development in low-income census tracts. Lending Club, p. 29. See Lending Club, p. 49; Small Business Majority, p. 2; CFSI, p. 2. 77 83 Id. 82 Id., p. 41 Page 18 of 22

21) ReedSmith Lending Club recommends that the marketplace lending industry fully adopt the practices and principles enumerated in the Small Business Borrower’s Bill of Rights, and that the regulatory agencies monitor the industry’s progress in extending credit to historically underserved populations.84 (6) Data Privacy Protection Given the recent large scale data breaches many commenters addressed data privacy and fraud protection. Equifax specifically noted that determining and then protecting the identity of consumers will necessarily be a multi-step process in marketplace lending: “As loan applications, supporting documentation, and decisions move online, it is important that lenders use all available tools to validate and authenticate consumer identity. Failure to properly do so will open up this channel to significant fraud perpetration.”85 The NCLC stressed its concerns regarding the use of consumer data in ways it argues are inconsistent with the Fair Credit Reporting Act (FCRA). It also emphasized the potential consumer harm that it claims “lead generators” can cause by selling consumer data to companies that use it to perpetrate fraud.86 (7) Reforms of the Secondary Market Commenters are split on the necessity and effects of regulation on the secondary market for marketplace loans. While commenters agree that there is currently no robust secondary market for marketplace loans, they are split on the reason for this.87 Commenters agree on the advantages of a secondary market for marketplace loans to provide access to liquidity, but offer little consensus on how to establish or administer such a market. Kabbage writes that however the secondary market is developed, it is important that there is some alignment between the performance risk associated with a particular loan and the organization that has determined that risk. Marketplace lenders without any capital risk put themselves in a position of mismatched incentives, the argument goes, because slightly lower stated risk can greatly increase the perceived return to the investors, and can also create long-term challenges if the assets do not perform in the manner promoted.88 Cross River Bank suggests that the secondary market is robust, and that “[t]he Federal government should promote standards for securitization of these assets to promote a liquid and efficient secondary 84 Id., pp. 14, 42 85 Equifax, p. 3. 87 See Lend Academy, p. 29, Kabbage, p. 2. NCLC, p. 2. 88 See Kabbage, p. 2. 86 Page 19 of 22

22) ReedSmith market for loans to, in turn, expand the availability of credit.”89 However, other commenters believe that a broker-dealer with an alternative trading designation could establish a secondary market for marketplace loans today, but that broker-dealers are not presently incentivized to do so. These commenters point to a current lack of profitability and regulation as the primary hurdle for such a market.90 Lending Club and Prosper point out that, due to cash from institutional investors, they do not have an immediate need for a secondary market to provide liquidity.91 89 Cross River Bank, p. 7. 90 Pepper Hamilton, p. 9. 91 Lending Club, p. 47; Prosper, p. 15. Page 20 of 22

23) ReedSmith IV. Conclusion Inevitably, many of the industry responses to Treasury’s RFI promote their authors’ technologies and products, and promise to revolutionize lending as we know it. Some mild puffery is to be expected. But taken as a whole, the advent of marketplace lending marks a significant evolutionary moment in the historical development of consumer financial services. The industry comments are sincere, insightful and forward-looking. And the exchange with Treasury pulls the curtain back on a financial services industry that has been changed irrevocably, and very quickly, by technology. In its comment, the OLA recalls a parallel in the “development of the national credit card industry in the 1980s.” 92 OLA cites the 1978 Supreme Court case of Marquette v. Omaha Serv. Corp., and the subsequent passage of the Depository Institution and Deregulatory Monetary Control Act of 1981, which granted “exportation powers to state chartered banks . . . and prompted the explosion of the credit card marketplace.”93 But online marketplace lending also evokes a more distant historical parallel as well. During the Depression of the 1930s, almost 10,000 American community banks closed their doors forever. Those banks had operated in towns and cities across the country, offering financial services (advice, 92 93 OLA, p. 4. Id. loans, business networks) to the consumers of the day (local farmers, businesses and families). Community banks pooled resources in order to facilitate lending, but they also had the benefit of social data about their communities and customers that allowed them to make credit decisions and provide a much needed service. The declining number of US banks has continued. In a December 2013 article, the Wall Street Journal noted that the “number of banking institutions in the US has dwindled to its lowest level since at least the Great Depression,” shrinking to less than 7,000 “for the first time since federal regulators began keeping track in 1934.”94 That number has continued to fall; as of September 2015, there were just 6,270 FDIC-insured banks in the US. Since that Wall Street Journal article was published just two years ago, however, an estimated $12 billion has been invested in FinTech companies and marketplace lenders globally. However, although these companies deploy new underwriting models and substitute social data of a different kind to “know” their customers and make credit decisions, the new tools arguably serve an age-old need to fulfil the demand of small businesses and individual borrowers to access credit. The US Department of the Treasury explicitly recognizes the promise and 94 WSJ.com (“Tally of US Banks Sinks to Record Low”), December 3, 2013, by Ryan Tracy. Page 21 of 22

24) ReedSmith potential of marketplace lending, and its goals and the views of a full spectrum of interested parties are collectively expressed in the RFI and the comments submitted in response. We look forward to the government’s reaction to those comments, and we will continue to watch its evolving relationship with marketplace lenders with anticipation in the coming months and years. Thank you for your interest, David S. Reidy Nicholas F.B. Smyth Heather Cantua Phillips Tyler M. Layton Reed Smith LLP FinTech Team San Francisco, January 14, 2016 Page 22 of 22

25) ReedSmith APPENDIX A The Reed Smith Team David S. Reidy Partner / Practice Leader, FinTech dreidy@reedsmith.com San Francisco +1 415 659 5933 Nicholas F.B. Smyth Associate nsmyth@reedsmith.com Pittsburgh +1 412 288 3167 Heather Cantua Phillips Associate hphillips@reedsmith.com San Francisco +1 415 659 4925 Tyler M. Layton Associate tlayton@reedsmith.com San Francisco +1 415 659 5959 David is a partner in the firm's Financial Industry Group and Practice Leader of the firm’s FinTech group. He represents financial services companies and other clients in consumer class and individual actions asserting privacy, fair lending, credit reporting, debt collection and unfair business practices claims, as well as Telephone Consumer Protection Act (TCPA) and California Invasion of Privacy Act (CIPA) cases. In addition to his extensive class action litigation experience, David counsels FinTech and other clients on compliance matters related to consumer financial services. David has tried cases to verdict in federal and state court, defeated dozens of cases at the summary judgment and class certification stages, and negotiated favorable class and individual settlements in many other matters. Nick is a member of the Financial Industry Group, practicing in the area of Financial Services Litigation. Previously, he spent four years as an Enforcement Attorney at the Consumer Financial Protection Bureau (CFPB), and he also helped draft the CFPB’s enabling legislation at the Treasury Department. Nick helps bank and nonbank clients prepare for and respond to examinations and investigations by the CFPB, including by conducting mock exams and assisting clients with remediation of selfidentified compliance issues and difficult decisions regarding selfreporting. He counsels banks and nonbanks that provide indirect auto finance on complying with the CFPB’s fair lending (ECOA) guidance, and he has helped clients navigate CFPB fair lending exams, including responding to PARR letters. Nick has also advised clients on other consumer financial laws, including UDAAP, FCRA, FDCPA, TILA, TISA, CLA, EFTA, RESPA, and implementing regulations. Heather focuses her practice in the area of financial services litigation, representing banks and other financial institutions in consumer class and individual actions, including mortgage banking, credit reporting, debt collection and unfair business practices litigation. Recently, she defeated consumer class actions brought against financial institutions under the Telephone Consumer Protection Act and Fair Credit Reporting Act. In 2014, Heather helped to defeat class certification and obtained summary judgment in a putative class action alleging violations of the Fair Credit Reporting Act. (Germain v. Bank of Am., N.A., No. 13-CV-676-BBC, 2014 WL 5802018, at *1 (W.D. Wis. Nov. 7, 2014)). Tyler is an associate in the Financial Industry Group, whose practice focuses primarily on representing banks and other financial institutions in mortgage banking, consumer protection, credit reporting, debt collection and unfair business practices litigation. Tyler has experience representing and counseling clients in all phases of federal and state litigation. Tyler’s practice also focuses on counseling emerging and established FinTech clients.

26) ReedSmith APPENDIX B Treasury’s RFI

27) 42866 Federal Register / Vol. 80, No. 138 / Monday, July 20, 2015 / Notices PTC implementation status update Respondent universe Total annual responses Average time per response Total annual burden hours Questionnaire to be completed by railroads required to implement PTC. 38 Railroads ................ 456 Surveys ................... 10 minutes ................... 76 Form Number(s): N/A. Respondent Universe: 38 Railroads. Frequency of Submission: Monthly. Total Estimated Responses: 456 Surveys. Total Estimated Annual Burden: 380 hours. Status: Emergency Review. Pursuant to 44 U.S.C. 3507(a) and 5 CFR 320.5(b), 1320.8(b)(3)(vi), FRA informs all interested parties that it may not conduct or sponsor, and a respondent is not required to respond to, a collection of information unless it displays a currently valid OMB control number. Authority: 44 U.S.C. 3501–3520. Issued in Washington, DC, on July 15, 2015. Rebecca Pennington, Chief Financial Officer. [FR Doc. 2015–17689 Filed 7–17–15; 8:45 am] BILLING CODE 4910–06–P DEPARTMENT OF THE TREASURY Public Input on Expanding Access to Credit Through Online Marketplace Lending Office of the Undersecretary for Domestic Finance, Department of the Treasury. ACTION: Notice and request for information. AGENCY: Online marketplace lending refers to the segment of the financial services industry that uses investment capital and data-driven online platforms to lend to small businesses and consumers. The Treasury Department is seeking public comment through this Request For Information (RFI) on (i) the various business models of and products offered by online marketplace lenders to small businesses and consumers; (ii) the potential for online marketplace lending to expand access to credit to historically underserved market segments; and (iii) how the financial regulatory framework should evolve to support the safe growth of this industry.1 2 mstockstill on DSK4VPTVN1PROD with NOTICES SUMMARY: 1 The Consumer Financial Protection Bureau (CFPB) has broad authority governing standards that may apply to a variety of consumer loans issued through this segment, and it has recently announced that it is considering proposing rules that would apply to payday loans, vehicle title VerDate Sep<11>2014 16:30 Jul 17, 2015 Jkt 235001 Submit comments on or before: August 31, 2015. ADDRESSES: Submit your comments through the Federal eRulemaking Portal or via U.S. mail or commercial delivery. We will not accept comments by fax or by email. To ensure that we do not receive duplicate copies, please submit your comments only one time. In addition, please include the Docket ID and the term ‘‘Marketplace Lending RFI’’ at the top of your comments. • Federal eRulemaking Portal: You are encouraged to submit comments electronically through www.regulations.gov. Information on using Regulations.gov, including instructions for accessing agency documents, submitting comments, and viewing the docket, is available on the site under a tab titled ‘‘Are you new to the site?’’ Electronic submission of comments allows the commenter maximum time to prepare and submit a comment, ensures timely receipt, and enables the Department to make them available to the public. • U.S. Mail or Commercial Delivery: If you mail your comments, address them to Laura Temel, Attention: Marketplace Lending RFI, U.S. Department of the Treasury, 1500 Pennsylvania Avenue NW., Room 1325, Washington, DC 20220. DATES: loans, deposit advance products, and certain highcost installment loans and open-end loans. See ‘‘Small Business Advisory Review Panel for Potential Rulemakings for Payday, Vehicle Title, and Similar Loans: Outline of Proposals Under Consideration and Alternatives Considered’’ (March 26, 2015), available at http:// files.consumerfinance.gov/f/201503_cfpb_outlineof-the-proposals-from-small-business-reviewpanel.pdf. The potential content, effects, and policy underpinnings of CFPB rules are outside the scope of this RFI, and comments responding to this RFI should not address these CFPB rulemakings or their potential effects on marketplace lending to consumers. Thus, the RFI only seeks comment on online marketplace lending not covered in the potential rulemakings, which, under the current framework, would include comments on the making or facilitating of a loan by online lender to consumers with a term of more than 45 days and an annual percentage rate (as defined in 10 U.S.C. 987(i)(4)) that (I) does not exceed 36% or (II) exceeds 36% provided the loan neither provides for repayment directly from a consumer’s account or paycheck nor creates a non-purchase money security interest in a vehicle. This framework is currently under discussion, however, and the CFPB may ultimately change the scope of any proposed or final CFPB regulation. 2 The activities on online marketplace lending platforms also may entail the offering of securities that are subject to the federal securities laws. PO 00000 Frm 00080 Fmt 4703 Sfmt 4703 • Privacy Note: The Department’s policy for comments received from members of the public (including comments submitted by mail and commercial delivery) is to make these submissions available for public viewing in their entirety on the Federal eRulemaking Portal at www.regulations.gov. Therefore, commenters should be careful to include in their comments only information that they wish to make publicly available on the Internet. FOR FURTHER INFORMATION CONTACT: For general inquiries, submission process questions or any additional information, please email Marketplace_Lending@ treasury.gov or call (202) 622–1083. All responses to this Notice and Request for Information should be submitted via http://www.regulations.gov to ensure consideration. If you use a telecommunications device for the deaf (TDD) or a text telephone (TTY), call the Federal Relay Service (FRS), toll free, at 1–800–877–8339. SUPPLEMENTARY INFORMATION: I. Request for Information The Treasury Department is seeking public comment through this RFI to study (i) the various business models of and products offered by online marketplace lenders to small businesses and consumers; (ii) the potential for online marketplace lending to expand access to credit to historically underserved market segments; and (iii) how the financial regulatory framework should evolve to support the safe growth of this industry. In particular, the Treasury Department is interested in responses to the following questions. We also seek any additional information beyond these questions that market participants believe would assist in our efforts to become better informed of the impact of online marketplace lending on small businesses, consumers, and the broader economy. Online marketplace lenders may be subject to regulations promulgated by various agencies including, but not limited to, the CFPB and the Federal Trade Commission. Respondents should provide as much detail as possible about the particular type of institution, product (e.g., small business loan, consumer loan), business model, and practices to which their E:\FR\FM\20JYN1.SGM 20JYN1

28) Federal Register / Vol. 80, No. 138 / Monday, July 20, 2015 / Notices comments apply. Responses to this RFI will be made public. mstockstill on DSK4VPTVN1PROD with NOTICES II. Purpose Historically, many American households, small businesses, and promising new enterprises have faced barriers in accessing affordable credit from traditional lenders. To date, the large majority of online marketplace consumer loans have been originated to prime or near-prime consumers to refinance existing debt. Online marketplace lending has filled a need for these borrowers by often delivering lower costs and faster decision times than traditional lenders. Non-prime consumers face other challenges in obtaining traditional bank-originated credit, particularly due to having thin or no credit files or damaged credit. Moreover, high underwriting costs can make it uneconomical to make smallvalue consumer loans. For example, it can cost the same amount to underwrite a $300 consumer loan as a $3,000 loan. Small-value loans to non-prime consumers thus have often come with triple digit annual percentage rates (APR). Some online marketplace lenders, however, are developing product structures and underwriting models that might allow making loans to non-prime borrowers at lower rates.3 With respect to small businesses, a number of studies have shown that these borrowers are more dependent on community banks for financing than larger firms, which have access to other forms of finance including public debt and equity markets. While larger businesses typically rely on banks for 30 percent of their financing, small businesses receive 90 percent of their financing from banks.4 Small business lending, however, has high search, transaction, and underwriting costs for banks relative to potential revenue—it costs about the same to underwrite a $5 million dollar loan as a $200,000 loan 5—and many small business owners report they are unable to access the credit needed to grow their business. According to Federal Reserve survey data released in February 2015, ‘‘a majority of small firms (under $1 million in annual revenues) and startups (under 5 years in business) 3 As noted elsewhere, the CFPB is contemplating issuing a rule that would regulate ‘‘payday’’ and related loans, including loans with terms greater than 45 days and an APR greater than 36%, if the loan also provides for repayment directly from a consumer’s account or paycheck or includes a nonpurchase money security interest in a vehicle. Such consumer loans are outside the scope of this RFI. 4 ‘‘2011 Economic Report of the President,’’ Council of Economic Advisors. The White House. 5 ‘‘The Future of Finance,’’ Goldman Sachs Equity Research, March 3, 2015. VerDate Sep<11>2014 16:30 Jul 17, 2015 Jkt 235001 were unable to secure any credit in the prior year.’’ 6 The challenge is particularly acute for small business loans of lower value and shorter terms. More than half of small businesses that applied for credit in 2014 sought loans of $100,000 or less. At the same time, more than two thirds of businesses with under $1 million in annual revenue that applied for credit received less than the full amount that they sought and half received none.7 Technology-enabled credit provisioning offers the potential to reduce transaction costs for these products, while investment capital may offer a new source of financing for historically underserved markets. The 2014 Small Business Credit Survey indicated that almost 20 percent of applicants sought credit from an online lender. While online marketplace lending is still a very small component of the small business and consumer lending market, it is a rapidly developing and fast-growing sector that is changing the credit marketplace. In less than a decade, online marketplace lending has grown to an estimated $12 billion in new loan originations in 2014, the majority of which is consumer lending.8 Through this RFI, Treasury is seeking to study the potential for online marketplace lending to expand access to credit and how the financial regulatory framework should evolve to support the safe growth of this industry. III. Background Online marketplace lending broadly refers to the segment of the financial services industry that uses investment capital and data-driven online platforms to lend either directly or indirectly to small businesses and consumers. This segment initially emerged with companies giving investors the ability to provide financing that would be used to fund individual borrowers through what became known as a ‘‘peer-to-peer’’ model. However, it has since evolved to include a diverse set of individual and institutional credit investors who seek to provide financing that ultimately is used to fund small business and consumer loans of various types to gain access to additional credit channels and favorable rates of return. Companies operating in this industry tend to fall into three general categories: (1) Balance sheet lenders that retain 6 ‘‘The Joint Small Business Credit Survey, 2014,’’ a collaboration among the Federal Reserve Banks of New York, Atlanta, Cleveland and Philadelphia. Released February 2015. 7 Ibid. 8 ‘‘Global Marketplace Lending: Disruptive Innovation in Financials,’’ Morgan Stanley Research, May 2015. PO 00000 Frm 00081 Fmt 4703 Sfmt 4703 42867 credit risk in their own portfolios and are typically funded by venture capital, hedge fund, or family office investments; (2) online platforms (formerly known as ‘‘peer-to-peer’’) that, through the sale of securities such as member-dependent notes, obtain the financing to enable third parties to fund borrowers and, due to the contingent nature of the payment obligation on such securities, do not retain credit risk that the borrowers will not pay; and (3) bank-affiliated online lenders that are funded by a commercial bank, often a regional or community bank, originate loans and directly assume the credit risk. Additionally, some of these companies have adopted a business model in which they partner and have agreements with banks. In these arrangements, the bank acts as the lender to borrowers that apply on the platform. The loans are then purchased by a second party — either by an investor, in which the transaction is facilitated by the marketplace lender, or by the marketplace lender itself, which funds the loan purchase by note sales. While the loans are not pooled, small investors can obtain a return by making small investments in a number of notes offered by a marketplace lender through its platforms. Online marketplace lenders share key similarities. They provide funding through convenient online loan applications and most have no retail branches. They use electronic data sources and technology-enabled underwriting models to automate processes such as determining a borrower’s identity and credit risk. These data sources might include traditional underwriting statistics (e.g., income and debt obligations), but also often include other forms of information, including novel data points or combinations. Online marketplace lenders typically provide borrowers with faster access to credit than the traditional face-to-face credit application process. Small business online market place lenders, provide small businesses with lower value (less than $100,000) and shorter terms. Key Questions 1. There are many different models for online marketplace lending including platform lenders (also referred to as ‘‘peer-to-peer’’), balance sheet lenders, and bank-affiliated lenders. In what ways should policymakers be thinking about market segmentation; and in what ways do different models raise different policy or regulatory concerns? 2. According to a survey by the National Small Business Association, 85 E:\FR\FM\20JYN1.SGM 20JYN1

29) 42868 Federal Register / Vol. 80, No. 138 / Monday, July 20, 2015 / Notices percent of small businesses purchase supplies online, 83 percent manage bank accounts online, 82 percent maintain their own Web site, 72 percent pay bills online, and 41 percent use tablets for their businesses.9 Small businesses are also increasingly using online bookkeeping and operations management tools. As such, there is now an unprecedented amount of online data available on the activities of these small businesses. What role are electronic data sources playing in enabling marketplace lending? For instance, how do they affect traditionally manual processes or evaluation of identity, fraud, and credit risk for lenders? Are there new opportunities or risks arising from these data-based processes relative to those used in traditional lending? 3. How are online marketplace lenders designing their business models and products for different borrower segments, such as: • Small business and consumer borrowers; • Subprime borrowers; • Borrowers who are ‘‘unscoreable’’ or have no or thin files; Depending on borrower needs (e.g., new small businesses, mature small businesses, consumers seeking to consolidate existing debt, consumers seeking to take out new credit) and other segmentations? 4. Is marketplace lending expanding access to credit to historically underserved market segments? 5. Describe the customer acquisition process for online marketplace lenders. What kinds of marketing channels are used to reach new customers? What kinds of partnerships do online marketplace lenders have with traditional financial institutions, community development financial institutions (CDFIs), or other types of businesses to reach new customers? 6. How are borrowers assessed for their creditworthiness and repayment ability? How accurate are these models in predicting credit risk? How does the assessment of small business borrowers differ from consumer borrowers? Does mstockstill on DSK4VPTVN1PROD with NOTICES 9 ‘‘2013 Small Business Technology Survey,’’ National Small Business Association. VerDate Sep<11>2014 16:30 Jul 17, 2015 Jkt 235001 the borrower’s stated use of proceeds affect underwriting for the loan? 7. Describe whether and how marketplace lending relies on services or relationships provided by traditional lending institutions or insured depository institutions. What steps have been taken toward regulatory compliance with the new lending model by the various industry participants throughout the lending process? What issues are raised with online marketplace lending across state lines? 8. Describe how marketplace lenders manage operational practices such as loan servicing, fraud detection, credit reporting, and collections. How are these practices handled differently than by traditional lending institutions? What, if anything, do marketplace lenders outsource to third party service providers? Are there provisions for back-up services? 9. What roles, if any, can the federal government play to facilitate positive innovation in lending, such as making it easier for borrowers to share their own government-held data with lenders? What are the competitive advantages and, if any, disadvantages for non-banks and banks to participate in and grow in this market segment? How can policymakers address any disadvantages for each? How might changes in the credit environment affect online marketplace lenders? 10. Under the different models of marketplace lending, to what extent, if any, should platform or ‘‘peer-to-peer’’ lenders be required to have ‘‘skin in the game’’ for the loans they originate or underwrite in order to align interests with investors who have acquired debt of the marketplace lenders through the platforms? Under the different models, is there pooling of loans that raise issues of alignment with investors in the lenders’ debt obligations? How would the concept of risk retention apply in a non-securitization context for the different entities in the distribution chain, including those in which there is no pooling of loans? Should this concept of ‘‘risk retention’’ be the same for other types of syndicated or participated loans? 11. Marketplace lending potentially offers significant benefits and value to PO 00000 Frm 00082 Fmt 4703 Sfmt 9990 borrowers, but what harms might online marketplace lending also present to consumers and small businesses? What privacy considerations, cybersecurity threats, consumer protection concerns, and other related risks might arise out of online marketplace lending? Do existing statutory and regulatory regimes adequately address these issues in the context of online marketplace lending? 12. What factors do investors consider when: (i) Investing in notes funding loans being made through online marketplace lenders, (ii) doing business with particular entities, or (iii) determining the characteristics of the notes investors are willing to purchase? What are the operational arrangements? What are the various methods through which investors may finance online platform assets, including purchase of securities, and what are the advantages and disadvantages of using them? Who are the end investors? How prevalent is the use of financial leverage for investors? How is leverage typically obtained and deployed? 13. What is the current availability of secondary liquidity for loan assets originated in this manner? What are the advantages and disadvantages of an active secondary market? Describe the efforts to develop such a market, including any hurdles (regulatory or otherwise). Is this market likely to grow and what advantages and disadvantages might a larger securitization market, including derivatives and benchmarks, present? 14. What are other key trends and issues that policymakers should be monitoring as this market continues to develop? Guidance for Submitting Documents: We ask that each respondent include the name and address of his or her institution or affiliation, and the name, title, mailing and email addresses, and telephone number of a contact person for his or her institution or affiliation, if any. Dated: July, 13, 2015. David G. Clunie, Executive Secretary, [FR Doc. 2015–17644 Filed 7–17–15; 8:45 am] BILLING CODE 4810–25–P E:\FR\FM\20JYN1.SGM 20JYN1

30) ReedSmith APPENDIX C List of Comments in Response to RFI

31) ReedSmith Company Name Page Count 1 Accion U.S. Network 12 2 Affirm, Inc. 8 3 Alliance Partners 22 4 Amalgamated Bank 3 5 Americans for Financial Reform 3 6 Association for Enterprise Opportunity 5 7 Avant, Inc. 4 8 Banking Up 2 9 Blue Elephant Capital Management 12 10 Bond Street 11 11 Broadmoor Consulting LLC 4 12 BuckleySandler 13 13 CAN Capital, Inc. 10 14 Center for Capital Markets Competitiveness 7 15 Center for Financial Services Innovation 6 16 Center for Responsible Lending 7 17 CommonBond, Inc. 11 18 Community Reinvestment Fund, Inc 15 19 Conference of State Bank Supervisors 9 20 Connect Lending 4 21 Cross River Bank 11 22 Crowdnetic 9 23 CUNA 3 24 Dealstruck 9 25 Distributed Finance Corporation 7 26 Duck Creek Tribal Financial, LLC 6 27 Earnest 3 28 Edward C. Yale CFA 2 29 Electronic Transactions Association 16 30 eOriginal 4 31 Equifax 3 32 Fundera 32 33 Funding Circle 44 34 GDR 4

32) ReedSmith Company Name Page Count 35 GLI Finance 7 36 Godolphin Capital Management, LLC 24 37 Habematolel Pomo of Upper Lake 11 38 Income & Technologies, Inc. 10 39 Independent Community Bankers of America 4 40 INSIKT 11 41 Kabbage, Inc. 10 42 Kiva Microfunds 12 43 KPMG LLP 12 44 Lend Academy 31 45 Lending Club 51 46 LendingTree 5 47 Lendio 10 48 LiftFroward 4 49 Manatt, Phelps & Phillips, LLP 5 50 Milken Institute Center for Financial Markets 13 51 Missouri Credit Union Association 2 52 Missouri Credit Union Association 2 53 MonJa 8 54 Mountain BizWorks 6 55 NAFCU 3 56 NASAA 3 57 National Association of Industrial Bankers 10 58 National Association of REALTORS 4 59 National Consumer Law Center 8 60 National Pawnbrokers Association 6 61 Native American Financial Services Association 9 62 Nelson Mullins 4 63 Office of the Mayor Chicago 1 64 OnDeck 22 65 Online Lenders Alliance 77 66 Oportun, Inc 19 67 Opportunity Finance Network 6 68 Opportunity Fund 7

33) ReedSmith Company Name Page Count 69 Orchard Platform 16 70 Otoe-Missouria 10 71 PayNet 9 72 PayPal Inc. 5 73 PeerIQ 22 74 Peer-to-Peer Finance Association 19 75 Pepper Hamilton 11 76 PIRG and Center for Digital Democracy 15 77 Prosper Marketplace 15 78 QTX Systems 21 79 RapidAdvance 15 80 RevenueTrades 15 81 Rosette, LLP 4 82 SIFMA 11 83 Small Business Majority 3 84 SoFi 7 85 Structured Finance Industry Group 15 86 The American Bankers Association and The Consumer Bankers Association 10 87 The Heritage Foundation 4 88 The Support Center 3 89 U.C. Berkeley Law School 11 90 University of Colorado Boulder 2 91 Upstart 4 92 WebBank 4 93 Woodstock Institute 8 94 ZestFinance 3

34) ReedSmith APPENDIX D Madden v. Midland