Severity: Notice

Message: Undefined variable: content_category

Filename: user/transcript.php

Line Number: 106

Severity: Warning

Message: Invalid argument supplied for foreach()

Filename: user/transcript.php

Line Number: 106

1) Informed Options Trading prior to M&A Announcements: Insider Trading?∗ Patrick Augustin† Menachem Brenner‡ Marti G. Subrahmanyam§ McGill University, Desautels New York University, Stern New York University, Stern First Draft: September 2013 This Draft: May 2014 Abstract We investigate informed trading activity in equity options prior to the announcement of corporate mergers and acquisitions (M&A). For the target companies, we document pervasive directional options activity, consistent with strategies that would yield abnormal returns to investors with private information. This is demonstrated by positive abnormal trading volumes, excess implied volatility and higher bid-ask spreads, prior to M&A announcements. These effects are stronger for out-of-the-money (OTM) call options and subsamples of cash offers for large target ï¬rms, which typically have higher abnormal announcement returns. The probability of option volume on a random day exceeding that of our strongly unusual trading (SUT) sample is trivial - about three in a trillion. We further document a decrease in the slope of the term structure of implied volatility and an average rise in percentage bid-ask spreads, prior to the announcements. For the acquirer, we provide evidence that there is also unusual activity in volatility strategies. A study of all Securities and Exchange Commission (SEC) litigations involving options trading ahead of M&A announcements shows that the characteristics of insider trading closely resemble the patterns of pervasive and unusual option trading volume. Historically, the SEC has been more likely to investigate cases where the acquirer is headquartered outside the US, the target is relatively large, and the target has experienced substantial positive abnormal returns after the announcement. Keywords: Asymmetric Information, Civil Litigations, Insider Trading, Mergers and Acquisitions, Market Microstructure, Equity Options, SEC JEL Classiï¬cation: C1, C4, G13, G14, G34, G38, K22, K41 ∗ We thank Yakov Amihud, Rohit Deo, Vic Khanna, Denis Schweizer, David Yermack, Zvi Wiener, Fernando Zapatero and seminar participants at the 2013 OptionMetrics Research Conference, the NYU Stern Corporate Governance Luncheon, the Penn-NYU Conference on Law and Finance, the CFA-JCF-Shulich Conference on Financial Market Misconduct, McGill University, the Luxembourg School of Finance and the 2014 Jerusalem Finance Conference for helpful comments and suggestions. We thank NERA Economic Consulting for sharing their data and we are also grateful to Yinglu Fu for outstanding research assistance. All errors remain our own. † McGill University - Desautels Faculty of Management, 1001 Sherbrooke St. West, Montreal, Quebec H3A 1G5, Canada. Email: Patrick.Augustin@mcgill.ca. ‡ New York University - Leonard N. Stern School of Business, 44 West 4th St., NY 10012-1126 New York, USA. Email: mbrenner@stern.nyu.edu. § New York University - Leonard N. Stern School of Business, 44 West 4th St., NY 10012-1126 New York, USA. Email: msubrahm@stern.nyu.edu.

2) 1 Introduction The recent leveraged buyout announcement of H.J. Heinz Inc. by an investor group consisting of Berkshire Hathaway Inc., controlled by Warren Buffett, and 3G Capital, a Brazilian privateequity ï¬rm, has sparked concerns about unusual option activity prior to the deal announcement. Was this abnormal volume in the options of Heinz Inc. an indication of trading based on insider information? Apparently the US Securities and Exchange Commission (SEC) thought so, alleging that a brokerage account in Switzerland was used for illegal insider trading. Another noteworthy case from an earlier period is the merger of Bank One with JP Morgan (JPM) Chase in 2004, in which one investor was alleged to have bought deep out-of-the-money (DOTM) calls just (hours) before the announcement. While these cases received considerable publicity, they are by no means isolated cases of such activity. Indeed, while the SEC has taken action in several cases where the evidence was overwhelming, one can assume that there are many more cases that go undetected, or where the evidence is not as clear-cut, in a legal/regulatory sense.1,2 Academic research on the role of informed trading in equity options around major news events, and, in particular, the announcements of mergers and acquisitions (M&A), has been scanty.3 We aim to ï¬ll this gap with the research presented in this paper. The objective of our study is to investigate and quantify the pervasiveness of informed trading, at least partly based on inside information, in the context of M&A activity in the US. To this end, we conduct a forensic analysis of the volume, implied volatility, and bid-ask spreads of options over the 30 days preceding the formal announcement of acquisitions.4 We focus on the target companies in M&A transactions, but also provide some preliminary evidence pertaining to the acquirers. More speciï¬cally, we examine option trading volumes (and prices and bid-ask spreads) prior to M&A announcements in the US from January 1, 1996 through December 31, 2012. We show that abnormal options activity prior to M&A announcements is consistent with strate1 Although the JPM/Bank One case received a lot of attention in the press, we are puzzled as to why this case does not appear in the SEC investigation/litigation ï¬les. However, we do document a large number of other SEC cases during our sample period. 2 See, for example, “Options Activity Questioned Again” in the Wall Street Journal, February 18, 2013. 3 Related cases of insider trading activity prior to earnings announcements, and other important corporate announcements, have received somewhat greater attention. 4 We examine alternative strategies that may yield abnormal returns to informed traders. The focus is on option strategies, although some of these may also involve trading in the underlying stocks. See the Internet appendix for details. 1

3) gies that would a priori lead to higher abnormal returns for investors with material non-public information: abnormal options trading volume that is particularly pronounced for short-dated, out-of-the-money (OTM) call options. This activity is associated with price and liquidity changes that are expected in the presence of an unusual trading volume with greater asymmetric information: excessive implied volatility, an attenuation of the term structure of implied volatility, and an increase in bid-ask spreads. We further show that no such patterns exist for any randomly chosen announcement dates, neither in the volume, nor in the prices or liquidity. Thus, if there is no (privately) expected increase in the target’s stock price, we do not generally observe abnormal options activity that would be consistent with trading by privately informed investors. From an academic point of view, options trading around M&As is a particularly attractive laboratory for the testing of hypotheses pertaining to insider trading, for several reasons. For one thing, M&A announcements are publicly unexpected events, in terms of timing and even occurence. Thus, on average, we should not be able to distinguish options trading activity before an announcement from that occurring on any randomly chosen date. In contrast to other corporate announcements, such as quarterly earnings announcements, M&As are likely the closest we can get to a truly unexpected event, while still allowing us to construct a meaningful sample. Second, the nature of private information is clearly identiï¬ed: a signiï¬cant rise in the target’s stock price upon the announcement in virtually all cases. This enables us to formulate clear hypotheses that we should fail to reject if informed trading is truly pervasive. Third, the richness of our options data, with detailed information regarding a large number of underlying stocks for multiple strike prices and expiration dates, is especially useful for formulating hypotheses about informed trading across several dimensions. We document evidence of a statistically signiï¬cant average abnormal trading volume in equity options written on the target ï¬rms in the US over the 30 days preceding M&A announcements. Approximately 25% of all the cases in our sample have abnormal volumes that are signiï¬cant at the 5% level, and for 15% the signiï¬cance is at a 1% level. The proportion of cases with abnormal volumes is relatively higher for call options (26%) than for put options (15%). Stratifying the results by “moneyness”, we ï¬nd that there is signiï¬cantly higher abnormal trading volume (both in average levels and frequencies) in OTM call options compared to at-the-money (ATM) and in-the-money 2

4) (ITM) calls.5,6 We also ï¬nd that ITM puts, as well as OTM puts, trade in larger volumes than ATM puts. This is strong evidence that informed traders may not only engage in OTM call transactions, but possibly also ITM put transactions.7 In addition to evidence of abnormal trading volumes in anticipation of M&A announcements, we provide statistical evidence that the two-dimensional volume-moneyness distribution shifts signiï¬cantly, to OTM call options with higher strike prices, over the 30 days prior to the announcement day. In order to distinguish informed trading from random speculative bets, we focus our attention on a subset of transactions, in which the informed trading is likely to be concentrated: low-priced options, trading just prior to the announcement and expiring just after it, with non-zero trading volumes. In these cases, the results are even sharper. We show that these trades are signiï¬cantly different from a randomly chosen matching sample on any other date, the probability of the unusual volume in the sample arising out of chance being about three in a trillion. We also exploit the low liquidity in equity options to quantify the pervasive unusual trading activity. More precisely, we quantify the likelihood that a sudden and signiï¬cant spike in the equity option trading volume, prior to a major informational event but following an extended period of no trading, is based on informed trading, rather than being random. The chance of observing a greater proportion of non-zero-volume observations on a random date is, at best, one in a million. We further provide statistical tests of positive excess implied volatility for target ï¬rms in the pre-event window. Thus, the relatively higher abnormal volumes in OTM call options for the targets translate, on average, into an increase in the implied volatility prior to the announcement day.8 Similarly, informed trading has an impact on equity option prices and leads to an attenuation of the term structure of implied volatility for target ï¬rms. We also ï¬nd that the percentage bid-ask spread for options on target ï¬rms rises from an average of 45% (35%) to 55% over the 30 (90) days preceding the announcement. This effect is signiï¬cant for DOTM and OTM call options, as well 5 The average cumulative abnormal volume in OTM call options is approximately 2,700 contracts greater than that in ATM call options, and 2,100 contracts greater than that in ITM call options. 6 It is shown in Internet appendix A that a wide variety of strategies for exploiting private information about an acquisition result in trading OTM calls or ITM puts. 7 As discussed later, and analyzed in detail in Internet Appendix A, it is unclear whether informed traders would take long or short positions in call and put options, since replication involving the underlying stock as well as the option can change the directional beneï¬ts of such trades. 8 It is important to note that there are many cases where the abnormal volume is not preceded by excess implied volatility, as discussed below. 3

5) as short- to medium-dated options. We show that informed trading is more pervasive in cases of target ï¬rms receiving cash offers, and less so when the target is being taken private as a result of the deal. We then explore the sub-sample of larger target ï¬rms receiving cash offers, and show that the effects documented in the overall sample are accentuated for these ï¬rms. We provide preliminary evidence for acquirer ï¬rms, for which informed traders would bet on an increase in jump risk, up or down, and engage in long-gamma strategies. We show that there is a statistically signiï¬cant increase in the trading volume of ATM options on the acquirer, ahead of the announcement of the acquisition. We then study the cases in which the SEC conducted an investigation into illegal insider trading ahead of M&A announcements, and ï¬nd that the SEC is likely to examine cases where the targets are large and experience substantial abnormal returns after the announcement, and where the acquirers are headquartered outside the US. The characteristics of the litigation sample closely resemble the anomalous statistical evidence we ï¬nd to be pervasive and non-random in a representative sample of M&A transactions. In particular, we persistently observe insider trades in short-dated and OTM call options initiated, on average, 16 days before the announcement. Yet, the modest number of civil lawsuits for insider trading in options made by the SEC appears small in comparison to the pervasive evidence we document. This paper provides a forensic analysis of trading volume and implied volatility for equity options, focusing on target ï¬rms involved in M&A announcements. It suggests a natural classiï¬cation scheme based on volume and price attributes that may be useful for regulators and prosecutors looking to detect insider trading activity. The structure of the paper is as follows. In Section 2, we provide a review of the relevant literature. We describe the data selection process and review the basic summary statistics in Section 3. The main hypotheses and methodology are presented in Section 4. We analyze the results for targets in the various subsections of Section 5.1. Section 5.2 deals with the acquirer sample. In Section 6 we provide an analysis of the SEC sample. We end with a summary and conclusions in Section 7. 4

6) 2 Literature Review Our work relates generally to the theoretical literature studying when and how informed agents choose to trade in the options market in the presence of, for instance, asymmetric information (Easley, O’Hara, and Srinivas (1998)), differences in opinion (Cao and Ou-Yang (2009)), short-sale constraints (Johnson and So (2012)), or margin requirements and wealth constraints (John, Koticha, Narayanan, and Subrahmanyam (2003)). More speciï¬cally, our objective is to identify informed, or even insider, trading in the options market ahead of unexpected public announcements, such as M&As. In this spirit, Poteshman (2006) concludes that informed investors traded put options ahead of the 9/11 terrorist attack. Keown and Pinkerton (1981) conï¬rm the leakage of information and excess stock returns earned through insider trading in the presence of merger announcements, but they do not investigate equity option activity. Meulbroek (1992) studies the characteristics of a sample of illegal insider trading cases detected and prosecuted by the SEC from 1980 to 1989, but likewise does not focus on option trading. Acharya and Johnson (2010) show that, for leveraged buyouts, the presence of more insiders leads to greater levels of insider activity, in the sense that a larger number of equity participants in the syndicate is associated with greater levels of suspicious stock and option activity.9 Chesney, Crameri, and Mancini (2011) develop statistical methods with ex-ante and ex-post information to detect informed option trades in selected industries and companies, conï¬rming that informed trading tends to cluster before major informational events. Our research relates more closely to Wang (2013), who investigates unusual option volume and price activity ahead of M&A announcements and questions how such activity predicts SEC litigation. In contrast, we study unusual option activity in much greater depth, use more sophisticated statistical techniques, and formulate more detailed and precisely stated hypotheses involving option strategies. We are also more exhaustive in our analysis of the information obtained from handcollected SEC litigation ï¬lings. While Frino, Satchell, Wong, and Zheng (2013) also hand-collect SEC litigation reports and study the determinants of illegal insider trading, they focus on stocks, not options as we do. Our paper also speaks to the literature that investigates the informational content of option trading volumes ahead of M&As for post-announcement abnormal stock returns. Cao, Chen, and 9 Acharya and Johnson (2007) also provide evidence of insider trading in the credit derivatives market. 5

7) Griffin (2005), for example, ï¬nd evidence that, for the target companies in M&A transactions, the options market displaces the stock market for information-based trading during the periods immediately preceding takeover announcements, but not in normal times.10 Focusing on the acquirer ï¬rms, Chan, Ge, and Lin (2014) provide evidence that the one-day pre-event implied volatility spread and the implied volatility skew, two proxies for informed option trading, are, respectively, positively and negatively associated with acquirer cumulative abnormal returns.11 The predictive power of both measures increases if the liquidity of the options is high relative to that of the underlying stocks. Barraclough, Robinson, Smith, and Whaley (2012) exploit the joint information set of stock and option prices to disentangle synergies from news in M&A transaction announcements. They also document that the increase in trading volume from the pre-announcement period to the announcement day is most dramatic for call options, with an increase of 212.3% for bidder call options, and an increase of 1,619.8% for target call options. We provide more granular evidence on the changes in the distribution of volume for different levels of option moneyness, ahead of announcements, which is worth examining in greater detail since the results presented in the literature are inconsistent across studies.12 Podolski, Truong, and Veeraraghavan (2013) also provide some indirect evidence that the option-to-stock volume ratio increases in the pre-takeover period, and increases relatively more for small deals that are less likely to be detected. Evidence of informed trading and the role of options markets in revealing information around M&A announcements, from the UK equity and options market, is provided by Spyrou, Tsekrekos, and Siougle (2011). Finally, Nicolau (2010) studies the behavior of implied volatility around merger announcements, and interprets positive abnormal changes in implied volatility prior to an announcement as evidence of information leakage. While the bulk of the empirical research on options markets focuses on index options, there 10 More speciï¬cally, the authors study a sample of 78 US merger or takeover ï¬rms between 1986 and 1994. Buyerseller-initiated call-volume imbalances, but not stock imbalances, are associated with higher stock returns the following day. However, during periods of normal trading activity, only buyer-seller-initiated stock-volume imbalances exhibit predictability, while option volume is uninformative. Option volume imbalances before M&A transactions are concentrated in ï¬rms that eventually have successful takeovers, and cannot be explained by target ï¬rm characteristics. 11 Chan, Ge, and Lin (2014) use a sample of 5,099 events relating to 1,754 acquirers, over the period 1996 to 2010. The implied volatility spread is calculated as the average difference between the implied volatilities of call and put options on the same security with the same strike and maturity. The implied volatility skew is calculated as the difference between the implied volatilities of OTM puts and ATM calls. 12 Poteshman (2006) focuses only on put options, Chesney, Crameri, and Mancini (2011) argue that there is more informed trading in put options, while Wang (2013) argues that there is higher abnormal volume for ATM call options. 6

8) are fewer studies using equity options (i.e., options on individual stocks), although they had been trading for almost a decade prior to the introduction of index options in the US.13 There are even fewer studies relating to informed trading around major informational events such as M&As, using option strategies, and those that exist are typically based on relatively small datasets. Even these studies tend to focus on either the target or the acquirer. In contrast, we study the trading patterns in the equity options of both the target and the acquirer, using data on both trading volumes and prices, highlighting the fundamental differences for insiders between directional and non-directional strategies. More speciï¬cally, we focus on the behavior of the entire volume distribution and the option-implied volatility across the depth-inthe-money dimension, prior to takeover announcements. Importantly, while some papers in the previous literature have investigated the informational content of option trading volumes for postannouncement stock returns, none of them have focused on the role of alternative option strategies in illegal insider trading. Moreover, in contrast to the above studies, which focus on various aspects of the M&A announcements using option data, our study focuses on the extent to which informed trading, possibly illegal, can be detected through the analysis of various option strategies, using both puts and calls in the target company and the acquirer. The likelihood of informed trading in these cases is explicitly quantiï¬ed in our analysis, and so too are the types of transaction - e.g., cash deals - that are particularly susceptible to such activity. Our study is also more comprehensive in scope than the above mentioned studies, is based on a much larger sample and uses rigorous statistical tests. A unique feature of our research is that we provide a detailed analysis of all the cases prosecuted by the SEC relating to insider trading in options prior to M&A announcements during the period of our study, and link them to our analysis of abnormal activity. 3 Data Selection and Summary Statistics The data for our study come from three primary sources: the Thomson Reuters Securities Data Company Platinum Database (SDC), the Center for Research in Securities Prices (CRSP) and OptionMetrics. The start date of our sample period is dictated by the availability of option infor13 The main constraint in the earlier period was the unavailability of complete data, which has changed dramatically with the advent of OptionMetrics as a reliable source for academic research in this area. 7

9) mation in OptionMetrics, which initiated its reporting on January 1, 1996. We begin our sample selection with the full domestic M&A dataset for US targets from SDC Platinum over the time period from January 1996 through December 2012. Our ï¬nal sample consists of 1,859 corporate transactions, for which we could identify matching stock and option information for the target. These deals were undertaken by 1,279 unique acquirers on 1,669 unique targets.14 For a subsample of 792 transactions, option information is available for both the target and the acquirer. We restrict our sample to deals aimed at effecting a change of control. In other words, to be included in our sample, the acquirer needs to have owned less than 50% of the target’s stock before the transaction, and to have been seeking to own more than 50% after the transaction. Hence, we include only mergers, acquisitions, and acquisitions of majority interest in our sample, thereby excluding all deals that were acquisitions of partial interest/minority stake purchases, acquisitions of remaining interest, acquisitions of assets, acquisitions of certain assets, recapitalizations, buybacks/repurchases/self-tender offers, and exchange offers. In addition, we exclude deals for which the status is pending or unknown, i.e., we only include completed, tentative or withdrawn deals. Next, we require information to be available on the deal value, and eliminate all deals with a transaction value below 1 million USD. Finally, we match the information from SDC Platinum with the price and volume information for the target in both CRSP and OptionMetrics. We require a minimum of 90 days of valid stock and option price and volume information on the target prior to, and including, the announcement date.15 We retain all options expiring after the announcement date and short-dated options expiring before the announcement date, as long as they are ATM. All matches between SDC and CRSP/OptionMetrics are manually checked for consistency based on the company name.16 Panel A in Table 1 reports the basic characteristics for the full sample, for which we require option information availability only for the target. Pure cash offers make up 48.6% of the sample, followed by hybrid ï¬nancing offers with 22.3%, and share offers with 21.7%. 82.9% of all transactions 14 Thus, 190 of the targets were involved in an unsuccessful merger or acquisition that was ultimately withdrawn. However, we include these cases in our sample, since the withdrawal occurred after the takeover announcement. 15 In other words, we also require the availability of long- and medium-dated options expiring after the event date. 16 Overall, we extract up to a maximum of one year of stock and option price information before and after the announcement date. The cut-off of one year is arbitrary, but follows from the trade-off of the following two objectives: having a sufficiently long time series before the announcement day to conduct an event study analysis, and keeping the size of the dataset manageable to minimize computational complexity. 8

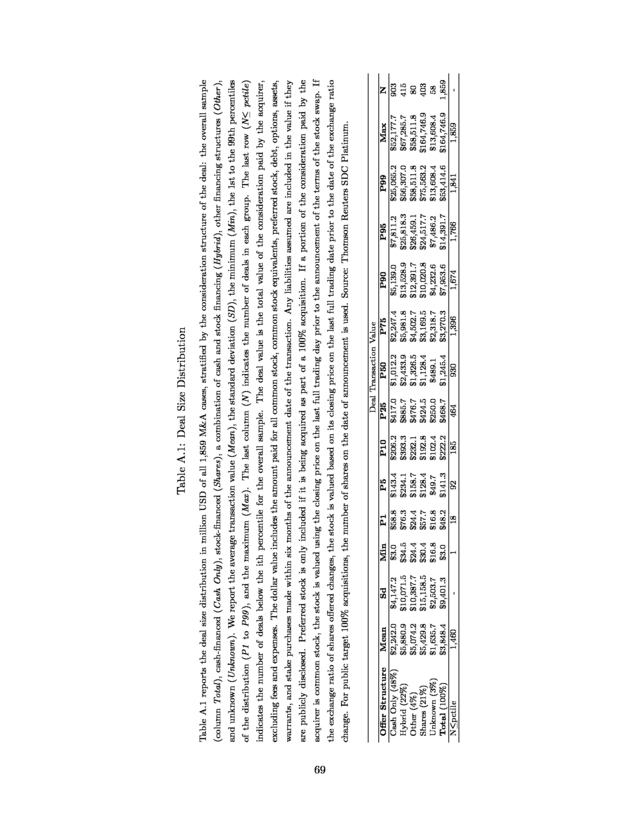

10) are completed, and mergers are mostly within the same industry, with 53.4% of all deals being undertaken with a company in the same industry based on the two-digit SIC code. 90.2% of all deals are considered to be friendly and only 3.4% are hostile, while 11.6% of all transactions are challenged.17 For a small subsample of 6.5% of the deals, the contracts contain a collar structure, 76.5% of all deals contain a termination fee, and in only 3.5% of the transactions did the bidder already have a toehold in the target company. Panel B shows that the average deal size is 3.8 billion USD, with cash-only deals being, on average, smaller (2.2 billion USD) than stock-only transactions (5.4 billion USD).18 The average one-day offer premium, deï¬ned as the excess of the offer price relatively to the target’s closing stock price, one day before the announcement date, is 31%. Statistics for the subsample for which we have option information on both the target and the acquirer are qualitatively similar. In Figure 1, we plot the average option trading volume in calls and puts for both the target and the acquirer, from 60 days before to 60 days after the announcement date. The increase in volume is a ï¬rst indication of information leakage prior to the public news announcements. There are two preliminary observations that can be made based on this cursory analysis. First, the unusual activity in the options of the target ï¬rm, is concentrated in a very narrow window around the announcement day, and occurs in both calls and puts. Second, the trading activity in the options of the acquirer ï¬rm is more dispersed, though most of it takes place close to the announcement day. However, these simple averages mask signiï¬cant cross-sectional differences in abnormal trading volumes across ï¬rms and options. A more detailed analysis is provided in Section 5, the empirical section that follows the discussion of our hypotheses. 4 Research Questions and Hypotheses We attempt to quantify the likelihood of informed trading by focusing on the trading activity in the options of both the target and the acquirer. Our analysis is focused on three different aspects of this broad issue: information obtained from the trading volume of options, information obtained from the option prices of these companies, and information from market microstructure effects. We 17 In the more recent past, there has been a dramatic increase in the number of deals that have been challenged by investors. See “First Rule of Mergers: To Fight Is to Lose”, in the Wall Street Journal, March 27, 2014. 18 Table A.1 in the Internet appendix provides more granular statistics on the deal size distribution. 9

11) investigate several hypotheses to test for such informed trading activity, mainly pertaining to the target ï¬rm.19 We emphasize in our hypotheses that an informed trader would pursue directional strategies for the target ï¬rm as the stock price almost always goes up after an announcement. On the other hand, for the acquirer, an informed trader would be more likely to pursue “volatility” trading strategies, as there is generally more uncertainty associated with the post-announcement direction of the stock price of the acquiring ï¬rm.20 The underlying assumption for all these hypotheses is that insiders are capital-constrained and would like to ensure that their private information is not revealed to the market prior to the trades, to minimize market impact.21 Also, in our analysis of potential strategies used by insiders, we do not explicitly consider the concern that this trading activity may be detected by the regulators, and how that may affect traders’ choice of strategies. We ï¬rst state and justify our hypotheses regarding the target ï¬rms and then discuss the hypothesis pertaining to the acquiring ï¬rms. 4.1 Target ï¬rms • H1: There is evidence of positive abnormal trading volume in equity options written on the target ï¬rms, prior to M&A announcements. If informed trading is present, but there is no leakage of information, informed traders should beneï¬t relatively more from strategies that use options, due to the leverage they can obtain from them, if they are capital-constrained. A takeover announcement is generally associated with a stock price increase for the target, usually a signiï¬cant one (for a survey, see Andrade, Mitchell, and Stafford (2001), for example). A trader who obtains prior knowledge 19 We write these hypotheses as statements of what we expect to ï¬nd in the data, rather than as null hypotheses that we would expect to be rejected. 20 This argument should be especially true for cash deals. While deals involving an exchange of stocks result in a decline of about 3% of the acquirer’s stock price, cash deals (48% of our sample) do not, on average, result in a decline, and there is considerable cross-sectional variation around these numbers. See Savor and Lu (2009), for example. 21 The informed trader faces the trade-off between transacting in the more liquid stock, where his trades are less likely to be discovered, or in the options market that provides more leverage, but where the chance of a price impact is greater. We do not analyze the stock market directly, but as long as capital constraints are binding, informed investors will, at least partly, migrate to the options market (see John, Koticha, Narayanan, and Subrahmanyam (2003)). Cao and Ou-Yang (2009) argue that speculative trading will occur in the options market mainly around major informational events if investors disagree about the future value of stock prices. Therefore, our focus, in this paper, is on informed trading in the options market. Nevertheless, we show in Figure A.1 of the Internet appendix that there is a strong increase in the ratios of call-to-stock volume and call-to-put volume, but only a modest increase in the ratio of put-to-stock volume. Detailed analysis of the question of whether informed trading is greater in the options market than in the stock market is left for future research. 10

12) of an upcoming deal and intends to use this information to trade is likely, given his capital constraints, to at least partly engage in leveraged trading strategies that will maximize his proï¬ts. The obvious venue for such activity is the options market, where we would expect to see signiï¬cant abnormal trading volumes in options for the target ï¬rms in anticipation of major corporate takeover announcements. Given the importance of leverage, we can sharpen the above hypothesis as follows in Hypothesis H2. • H2: The ratios of the abnormal trading volumes in (a) OTM call options to ATM and ITM call options, and (b) ITM put options to ATM and OTM put options, written on the target ï¬rms, are higher prior to M&A announcements. In the presence of superior information, a trading strategy involving the purchase of OTM call options should generate signiï¬cantly higher abnormal returns, as a consequence of the higher leverage (“more bang for the buck”). Hence, we expect a relatively larger increase in abnormal trading volume for OTM calls relative to ATM and ITM calls, in the presence of superior information.22 Moreover, an insider, taking advantage of his privileged knowledge of the direction of the target’s stock price evolution, is also likely to increase the trading volume through the sale of ITM puts, which will become less valuable when the announcement is made, followed by an upward move in the stock price of the target. An alternative strategy, arising from put-call-parity, would be to buy ITM puts coupled with the underlying stock, ï¬nanced by borrowing (mimicking the strategy of buying OTM calls). A possible reason for engaging in such a strategy rather than the more obvious one of buying OTM calls could be the lack of liquidity in OTM calls: a large order may have a signiï¬cant market impact and even reveal the information to the market. Thus, an abnormally high volume in ITM puts may result from either the strategy of mimicking the purchase of OTM calls or the strategy of taking a synthetic long position in the stock. One possibility is that an informed trader may engage in more complicated trading strategies to hide his intentions. However, it turns out that, irrespective of which alternative trading strategy is applied, we should observe abnormal trading volume in OTM call and/or ITM 22 This possibility corresponds to the case study of JPM-Chase merging with Bank One, which exhibits such a pattern. 11

13) put options.23 Ex ante, it is not clear whether the trading strategies should effectively result in “buys” or “sells” of OTM calls and ITM puts. This is, however, not a concern as OptionMetrics only reports the unsigned trading volume. Thus, our hypothesis that we should observe relatively higher trading volumes in OTM calls and potentially ITM puts encompasses a rich analysis of multiple trading strategies. • H3: There is positive excess implied volatility for equity options written on the target ï¬rms, prior to M&A announcements. Informed traders who have accurate information about the timing of an announcement and the offer price will tend to buy OTM calls just prior to the announcement (for example, as in the JPM-Bank One case). To obtain leverage, they will buy OTM calls that are likely to become ITM when the stock price reaches or exceeds the takeover offer price. If they are conï¬dent about their information, they will be willing to pay the offer price of the option market-maker, typically the seller of such options. Informed traders who anticipate a deal, but are uncertain of the offer price and the timing, will typically buy options that are closer to the money, and will also be willing to pay the offer price. Assuming that the equilibrium price of the option is, on average, between the bid and ask prices, buying at the ask price will result directly in higher excess volatility.24 The wider is the bid-ask spread, the greater will be the measured excess volatility, due to the convexity of option prices. Thus, we anticipate excess implied volatility, albeit not especially large, for all options on the target. • H4 : The percentage bid-ask spread for options written on target ï¬rms widens prior to M&A announcements. Similarly to the rationale behind Hypothesis H3, there should be no pattern in the bid-ask spread for the options on the target ï¬rm as the announcement date approaches, in the absence of insider activity. An increase in the percentage bid-ask spread conditional on abnormal trading volumes would be a natural response of the market-makers to such asymmetric in23 For a detailed analysis of alternative directional trading strategies that should result in abnormal volumes of OTM calls and/or ITM puts, see Internet Appendix A. 24 This argument can be related to prior work on the inelasticity of the option supply curve, along the lines analyzed theoretically by Garleanu, Pedersen, and Poteshman (2009) and empirically by Bollen and Whaley (2004) and Deuskar, Gupta, and Subrahmanyam (2011). 12

14) formation. This would be indirect evidence that there were informed traders in this market prior to the announcement date, but not necessarily that the information about a potential merger had leaked to the whole market. • H5: The (right) skewness of the option smile/skew, for target ï¬rms, increases prior to M&A announcements. Considering Hypotheses H2, H3, and H4, we expect that the demand for OTM call options, especially where the buyers pay the offer price, could increase the price of OTM call options relative to the price of OTM puts.25 If the implied volatility/strike price graph is initially a “smirk”, it should become “flatter” due to the actions of an informed trader. On the other hand, if the graph is more like a “smile”, we should observe a steeper smile on the right-hand side due to these informed trades. • H6: The term structure of implied volatility decreases for options on the target ï¬rms before takeover announcements. Informed traders can obtain the highest leverage by buying short-dated OTM call options, that expire soon after the announcement date. Given this preference, demand pressure on short-dated options should lead to a relative price increase (or a tendency to buy at the offer price) in options with a shorter time to expiration, compared to long-dated options. Thus, the term structure of implied volatility should decrease for call options written on target ï¬rms. 4.2 Acquirer ï¬rms • H7: In anticipation of major news events, there is a volume increase in long-gamma trading strategies for acquirer ï¬rms prior to M&A announcements. As explained above, since, in the case of the acquirer, there is general uncertainty regarding the direction in which the price of the stock will move after the announcement, an informed trader will not make a directional trade using OTM options. Rather, he will trade on the possibility of a jump in the stock price of the acquirer in either direction. The obvious strategy to use to take advantage of this information would be a high-gamma strategy, e.g., buying 25 The change in the skewness of the option smile/skew would also depend on the extent to which ITM puts were dominated by buyers or sellers, as argued in H2. 13

15) ATM straddles. Thus, we anticipate an increase in the volume of ATM straddles. As stated above, this is likely to be particularly true for cash deals, which comprise a little less than half of our sample. In stock-ï¬nanced deals, on average, there is a decline of 3% in the acquirer’s stock price. Though there are a number of such cases where there is no decline or even an increase, the insider may employ a directional strategy or a mixed one (directional/volatility) for these deals, due to the negative average. 5 Empirical Analysis 5.1 Target Firms We investigate the ï¬rst six hypotheses along the three dimensions identiï¬ed above: the trading volume, price and liquidity (bid-ask spread) of options traded on target ï¬rms. We begin by looking into the behavior of volume, prior to the M&A announcement dates. 5.1.1 Abnormal Volume In order to address Hypotheses H1 and H2, we conduct a forensic analysis of the trading volume in equity options during the 30 days preceding takeover announcements. We ï¬rst summarize the descriptive statistics of the option trading volume in our sample. We then test for the presence of positive abnormal volumes in call and put options across moneyness categories, using a variation of the conventional event-study methodology. Next, we formally test, using an approximation to the bivariate Kolmogorov-Smirnov test, whether the entire volume-moneyness distribution shifts in anticipation of takeover news releases, i.e., whether there is an increase in the OTM call volume relative to ATM and ITM calls as we approach the event day. We next look at speciï¬c trades that are most susceptible to insider trading, and compare them to a matched random sample. We also examine the prevalence of zero-volume runs (“conditional trading volume”) in the periods before announcements in comparison to a sample preceding a random date. Finally, we use regression analysis to infer the characteristics of the cumulative abnormal volume, which leads us to a deeper analysis of the subsample of cash-ï¬nanced deals. • A. Statistics of the Equity Option Trading Volume 14

16) We start by reporting basic summary statistics for the option trading volumes of the target ï¬rms, stratiï¬ed by time to expiration and moneyness, in Table 2.26 We classify our sample into three groups in terms of time to expiration: less than or equal to 30 days, greater than 30 days but less than or equal to 60 days, and more than 60 days. In addition, we sort the observations into ï¬ve groups of moneyness, where moneyness is deï¬ned as S/K, the ratio of the stock price S to the strike price K. DOTM corresponds to S/K ∈ [0, 0.80] for calls ([1.20, ∞) for puts), OTM corresponds to S/K ∈ (0.80, 0.95) for calls ([1.05, 1.20) for puts), ATM corresponds to S/K ∈ (0.95, 1.05) for calls ((0.95, 1.05) for puts), ITM corresponds to S/K ∈ [1.05, 1.20) for calls ((0.80, 0.95] for puts), and DITM corresponds to S/K ∈ [1.20, ∞) for calls ([0, 0.80] for puts). Panels A to C report summary statistics for all options in the sample, while Panels D to F and G to I report the numbers separately for calls and puts, respectively. First, regardless of moneyness, the level of trading volume, as indicated by the mean volume statistics, is signiï¬cantly higher for short and medium-dated options than for long-dated options. For example, the average numbers of traded contracts in OTM options for target ï¬rms are 370 and 285 contracts, for maturities of less than 30 and 60 days respectively, while the number is 130 contracts for options with more than 60 days to maturity. This difference is more pronounced for call options than for put options.27 Second, the highest average trading volume tends to be associated with OTM options. • B. Abnormal Trading Volume - Event Study Hypothesis H1 asserts that there is a positive abnormal trading volume in call equity options written on the target prior to a public M&A announcement. We test this formally by running a classical event study. For each of the 1,859 deals in the sample, we obtain the aggregated option volume on the target’s stock, as well as the aggregated volume traded in calls and puts. To compute the abnormal trading volume, we use, as a benchmark, a constant-mean-trading26 Since equity option markets are fairly illiquid, the trading volume data are characterized by numerous zero-volume observations. These data points are omitted from the calculation of the basic summary statistics. 27 Note that, in the entire sample, including both targets and acquirers, the average trading volumes are 1,084 contracts for ATM options, 497 and 398 contracts, respectively, for OTM and ITM options, and 127 and 214 contracts, respectively, for DOTM and DITM options. 15

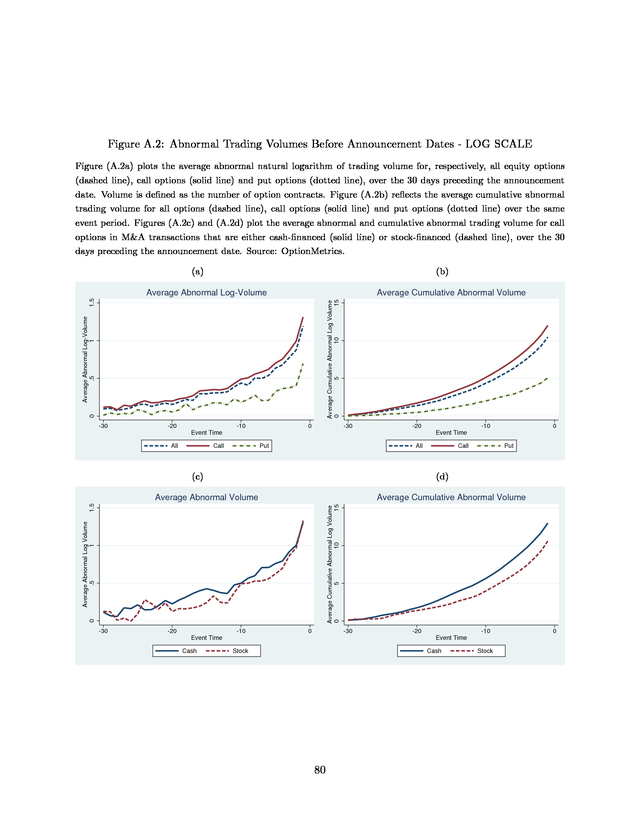

17) volume model, as well as two different volume-based versions of the market models. We deï¬ne the market trading volume as the median (mean) call and put trading volume across all options in the OptionMetrics database. As we are interested in the abnormal trading volume in anticipation of the event, we use, as the estimation window, the period starting 90 days before the announcement date and ï¬nishing 30 days before the announcement date. Our event window stretches from 30 days before to one day before the announcement date. To account for the possibility of clustered event dates, we correct all standard errors for cross-sectional dependence. The results are reported in Table 3. The average cumulative abnormal trading volume for the target ï¬rms is positive and statistically signiï¬cant across all model speciï¬cations.28 The magnitude of the average cumulative abnormal volume over the 30 pre-event days is estimated to be 11,969 contracts for call options, using the median market model. For put options on the target, the average cumulative abnormal volume is also positive and highly statistically signiï¬cant, but over the 30 pre-event days is, at 3,471 contracts, much smaller. The evolution of the average abnormal and cumulative abnormal trading volume for the targets is illustrated in the two panels in Figure 2. It is apparent that the average cumulative abnormal trading volume in put options is quantitatively less important than that in call options, which is primarily driving the results for the overall sample. The daily average abnormal volume for call options is positive and steadily increasing to a level of approximately 1,500 contracts the day before the announcement. Individually, the number of deals with positive abnormal trading volumes at the 5% signiï¬cance level ranges from 472 to 492 for calls, and from 271 to 319 for puts, corresponding to 26% and 15% of the entire sample respectively.29 These results conï¬rm the Hypothesis H1, that there are positive abnormal trading volumes in call and put equity options written on the targets prior to public M&A announcements. In addition to the aggregated results, we stratify our sample by moneyness, and conduct an 28 We report in Table A.2 of the appendix results based on a log transformation of volume Vt , such that the transformed volume tV olt is deï¬ned as tV olt = ln(1 + Vt ). The ï¬ndings are similar. The corresponding graphs are available in Figure A.2. 29 Unreported results indicate that, at the 1% signiï¬cance level, the number of deals with positive abnormal trading volumes in the entire sample ranges from 278 to 292 for calls, and from 138 to 195 for puts, corresponding to frequencies of 16% and 8%, respectively, depending on the market model used as a benchmark. 16

18) event study for each category. We ï¬nd that there is signiï¬cantly higher abnormal trading volume for the targets in OTM call options, compared to ATM and ITM calls, both in terms of volume levels and frequencies. Using the median market model, for instance, Table 3 shows that the average cumulative abnormal volume is 3,797 (1,860) contracts for OTM calls (puts) and 1,702 (1,110) contracts for ITM calls (puts), while it is 1,059 (188) for ATM calls (puts). These values correspond to 383 (300, 448) deals, or 21% (16%, 24%) of the sample for OTM (ATM, ITM) calls, and 387 (254, 316) deals or 21% (14%, 17%), for OTM (ATM, ITM) puts, respectively. In addition, while we ï¬nd that the average cumulative abnormal volume is positive and statistically signiï¬cant for both OTM and ITM calls and puts, it is only statistically signiï¬cant at the 5% level for ATM call options, and not for put options. In Panel B, we differentiate between the results for cash- and stock-ï¬nanced takeovers. The number of deals with statistically signiï¬cant positive abnormal trading volume represents about 26% for both subgroups, which is similar to the results in the overall sample. However, the level of the cumulative abnormal volume is greater for cash than for stock deals, for both call and put options.30 For instance, using the mean market model for the pooled sample, the expected cumulative abnormal volume is 16,567 contracts for cash deals, and 9,530 contracts for stock deals. The differences in the average and cumulative abnormal call option volumes are graphically illustrated in Figures 2c and 2d. Panel C reports the results from paired t-tests for the differences in means of the cumulative average abnormal volumes across different depths. Consistent with our Hypothesis H2, these results emphasize that there is higher abnormal trading volume for OTM call options, compared to ATM and ITM call options. The differences in means, using the median market model, for OTM calls relative to ATM and ITM calls are 2,738 and 2,096 respectively, which are positive and statistically different from zero. On the other hand, the difference in means between ATM and ITM calls is slightly negative (-643), but not statistically different from zero. We do conï¬rm that the average cumulative abnormal volume for ITM put options is higher than for ATM put options. This provides some preliminary evidence that informed 30 While the cumulative abnormal options volume is greater for cash deals than for stock deals, we do not ï¬nd the difference to be statistically signiï¬cant. 17

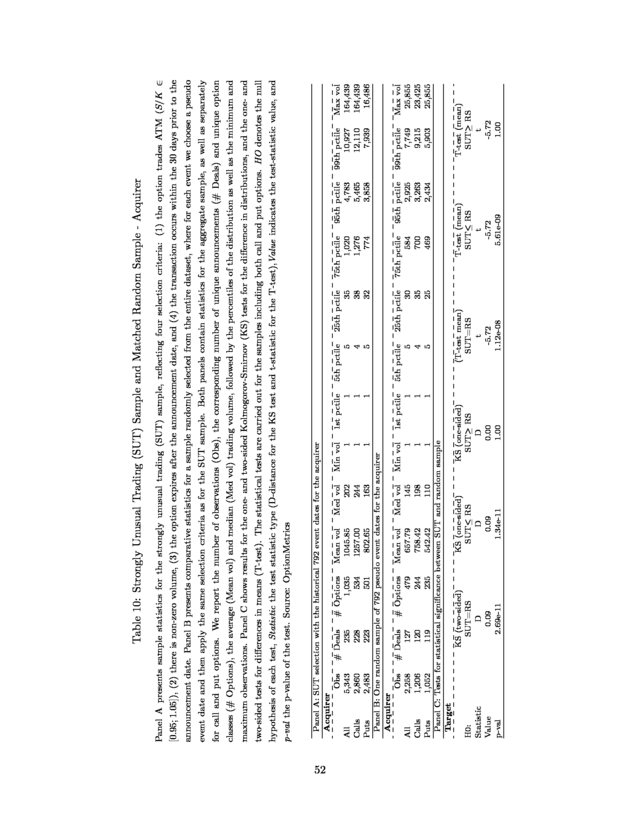

19) traders may not only engage in OTM call transactions but may also sell ITM puts.31 To summarize, the event study further supports Hypotheses H1 and H2. In other words, there is ample evidence of positive abnormal volumes in equity options for the target ï¬rms in M&A transactions, prior to the announcement date. In addition, we document that, for the targets, there is a signiï¬cantly larger amount of abnormal trading volume in OTM call options than in ATM and ITM call options. There is also greater abnormal trading volume in cash- than in stock-ï¬nanced takeovers. However, the evidence that informed traders may also engage in writing ITM put options is not as strong.32 • C. Shifts in the Option Trading Volume Density The previous section illustrated that the 30 days prior to M&A announcement dates exhibit abnormal option volumes for target ï¬rms that are particularly pronounced in OTM call options. The question is whether there is a monotonic and statistically signiï¬cant shift in the entire option trading volume distribution as the announcement date approaches. We formally test for a shift in the bivariate volume-moneyness distribution over time, in anticipation of the announcement dates. Figure 3 visually illustrates the shift in the volume distribution for calls and puts written on the target ï¬rms as we approach the announcement date. Each individual line reflects a local polynomial function ï¬tted to the volume-moneyness pairs. It is striking to see how the volume distribution for call options shifts to the tails and increases the weights of the DITM and DOTM categories as we approach the announcement date. In addition, the volume keeps increasing, in particular in the event window [−4, −1]. The last event window [0, 0] incorporates the announcement effect, whereby the overall average trading level is lifted upwards, and the distribution shifts to ITM call options and OTM puts, as would be expected as the merger has been announced. Another way to visualize the change in the distribution is shown in Figure 4, although this graph is a univariate slice of the underlying bivariate distribution. 31 The expected cumulative abnormal volume for OTM put options is slightly higher than that for ITM put options. The difference of 750 contracts is nevertheless small, given that it is a cumulative measure over 30 days. 32 One reason for this discrepancy may be that writing naked puts is a risky position, especially ITM puts. There is always some probability that the deal will not go through and the stock will tumble. Also, selling naked puts requires a large margin, which may be a binding constraint in the context of limited capital. 18

20) The dashed blue line and the solid green line in each plot represent the 90th and 95th percentiles of the distribution, whereas the dotted red lines reflect the interquartile range. It is evident from the ï¬gure that the percentage increase in the percentiles of the volume distribution is very strong. For example, the interquartile range for target call options increases from a level below 50 contracts to approximately 2,000 contracts on the announcement day. To summarize, there is a signiï¬cant shift in both the mean and median trading volume for target ï¬rms in anticipation of M&A transactions. This shift is more pronounced for DOTM and OTM call options, than for ITM and DITM options. This conï¬rms Hypothesis H2 that there is a higher abnormal trading volume in DOTM call options than in ATM and ITM call options. In what follows, we apply a formal statistical test for the shift in the volume distribution. In order to test whether the bivariate volume-moneyness distribution shifts over time prior to announcement dates, we use a two-sample bivariate Kolmogorov-Smirnov (KS) test. The two-sample KS test is a non-parametric test for the equality of two continuous distribution functions. Essentially, the KS-statistic quantiï¬es the distance between the two empirical cumulative distribution functions. While the test statistic is straightforward to compute in the univariate setting with distribution-free properties, the computation in the multivariate setting can become burdensome, particularly when the sample size is large. The reason for this is that, in the univariate setting, the empirical cumulative distribution function diverges only at its observed points, while it diverges at an inï¬nite number of points in the multivariate setting. To see this, remember that, in a multivariate setting, there is more than one deï¬nition of a cumulative distribution function. In particular, in the bivariate setting, the four regions of interest are H (1) (x, y) = P [X ≤ x, Y ≤ y] , H (1) (x, y) = P [X ≥ x, Y ≤ y] , H (1) (x, y) = P [X ≤ x, Y ≥ y] (1) H (1) (x, y) = P [X ≥ x, Y ≥ y] , (2) and we need to evaluate the empirical cumulative distribution function in all possible regions. To reduce computational complexity, we rely on the Fasano and Franceschini (FF) generaliza19

21) 1 tion of the two-sample bivariate KS test. Deï¬ne the two sample sizes { x1 , yj : 1 ≤ j ≤ n} j 2 and { x2 , yj : 1 ≤ j ≤ m}, with their corresponding empirical cumulative distribution funcj (k) (k) tions Hn and Hm , for regions k = 1, 2, 3, 4. The FF test statistic (Fasano and Franceschini (1987)) is then deï¬ned as (1) (2) (3) (4) Zn,m = max{Tn,m , Tn,m , Tn,m , Tn,m }, (3) where (k) Tn,m = sup(x,y)∈R2 nm (k) H (k) (x, y) − Hm (x, y) . n+m n (4) Although the analytic distribution of the test statistic is unknown, its p-values can be estimated using an approximation, based on Press, Teukolsky, Vetterling, and Flannery (1992), to the FF Monte Carlo simulations. Our prior is that the FF-statistic, which reflects the distance between the two bivariate empirical distribution functions (EDFs), should monotonically increase for target ï¬rms as we get closer to the announcement date.33 Essentially, the difference in EDFs should be larger between event windows [−29, −25] and [−24, −20], than between [−29, −25] [−19, −15], and so forth. In addition, the FF-statistics should increase relatively more for short-dated options, which mature closer to, but after, the announcement date. These predictions are clearly conï¬rmed by the results in Table 4. The FF test reveals statistically signiï¬cant differences in the bivariate volume-moneyness distributions, as we move closer to the announcement date. We compare the distributions in event-window blocks of ï¬ve days. A glance at the table reveals that the test is statistically signiï¬cant, at the 1% level, for almost all pair-wise comparisons. In addition, the magnitude of the statistic is monotonically increasing as we move from the left to the right, and as we move from the bottom to the top of the table. Panels A and B in Table 4 report the results for calls and puts, respectively. For example, 33 One can think of the FF-statistic as a variation of the KS-statistic in the multivariate setting. The FF-statistic is computationally less intensive in the multivariate case, but is consistent and does not compromise power for large sample sizes. See Greenberg (2008). 20

22) the ï¬rst row shows that the bivariate distribution signiï¬cantly shifts from event window [−29, −25] to [−24, −20], with an FF-statistic of 0.0279. The test statistic increases to 0.1592, if we compare event windows [−29, −25] and [−4, −1], and to 0.4070 for event windows [−29, −25] and [0, 0]. For short-dated options with a time to expiration of less than 30 days, the statistic for the difference in distributions for the shift from event window [−29, −25] to [−4, −1], excluding the announcement effect, has a value of 0.3388 (0.34) for call (put) options. This is higher than the announcement effect from event window [−4, −1] to the announcement date. Changes in the bivariate distributions are statistically signiï¬cant at the 1% level for almost all event windows. Overall, as expected, the largest test statistics seem to be associated with comparisons between the announcement date ([0, 0]) and the event window immediately preceding it ([−4, −1]). These formal statistical tests provide evidence that the two-dimensional volume-moneyness distribution shifts signiï¬cantly in both time and depth over the 30 days preceding the announcement day. Hence, the level of the volume distribution increases, with a higher frequency of trades occurring in both OTM calls and ITM puts. These ï¬ndings support the results of the event study and strengthen our conclusions in favor of Hypotheses H1 and H2. In the following subsection, we test whether such a shift in the bivariate distribution is truly random, by comparing the volume distribution of a sample of suspiciously unusual trades to that of a randomly matched sample. • D. Strongly Unusual Trading Volume and Matched Random Sample Our primary goal is to distinguish informed trading from random speculative bets. Hence, we are looking for unusual trading patterns that are clearly different from the patterns exhibited by randomly selected samples, since evidence of non-random trading would point to the existence of informed trading. We analyze extreme cases that are potentially the most likely to reflect informed trading. In this spirit, we deï¬ne as strongly unusual trading (SUT), observations (deï¬ned as the trading volume for an option-day pair, i.e., the end-of-day volume for a given option on the target) meeting the following four criteria for individual options: (1) The daily best recorded bid is zero. This corresponds implicitly to DOTM options where the 21

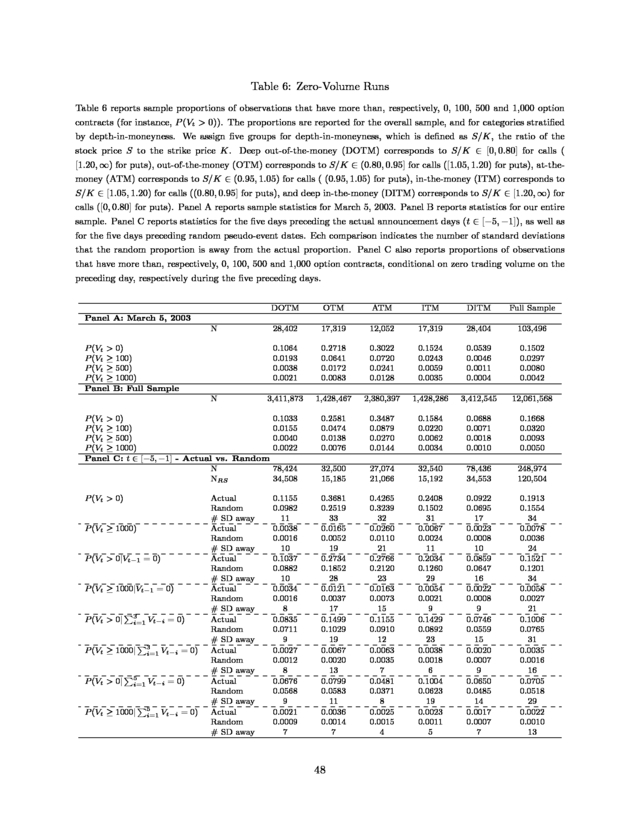

23) market-maker, through his zero bid, signals his unwillingness to buy, but is willing to sell at a non-zero ask price. (2) The option expires on or after the announcement day, but is the ï¬rst one to expire thereafter (the so-called front month option). Obviously, an insider would buy options that were going to expire soon after the announcement: in order to get the biggest bang for his buck, he would try to buy the cheapest ones, these being the ones most likely to end up ITM. Short-dated OTM options tend to be cheaper and provide the greatest leverage. (3) The option has strictly positive trading volume. Since many individual equity options, especially those that are OTM, have zero trading volume (although all options have quotes in the market-making system), we focus on those that have positive volume, since a zero-volume trade cannot be unusual, by deï¬nition. (4) Finally, the transaction takes place within the 30 days preceding the event date, deï¬ned as the 0 date (i.e., between event dates -29 and 0). An informed trader faces a trade-off in that he must leverage on his private information prior to the event, while avoiding trading too close to the event, as that may entail a higher risk of alerting other market participants or triggering an investigation by the regulators.34 Table 5 presents the sample statistics for the SUT sample. From the entire dataset, we identify 2,042 option-day observations, for the target ï¬rms, that meet our SUT selection criteria.35 The share of calls is slightly more than half, with a total of 1,106 observations for target ï¬rms. The average trading volume is 124 option contracts, and the average trading volumes for calls and puts are, respectively, 137 and 108.36 The median trading volume is somewhat more stable, with a value of 20 contracts for options written on the target. We compare the statistics from the SUT sample with those from a randomly selected sample. The sampling procedure used to create the random sample is as follows: For each of the 1,859 events with options traded on the target ï¬rms, we randomly select a pseudo-event date. We treat the pseudo-event date as a hypothetical announcement date, chosen at random, and then apply the SUT selection criteria to it, i.e., we keep option-day observations with a zero 34 An additional aspect that we do not explicitly consider is the number of traders involved, and their connections with each other, which could reveal whether the information was shared by many players and potentially leaked to them. Presently, we do not have data on individual trades conducted in this period. 35 Note that the full sample has approximately 12 million observations. For each event, the event time spans the period from one year before to one year after the announcement date. 36 The average is taken across all observations satisfying the SUT selection criteria. 22

24) bid price, with non-zero trading volume, that are within 30 days of the pseudo-event date, and that have an expiry date after the pseudo-event date. The SUT sample statistics are compared to the random sample trading (RST) statistics in Panel B of Table 5.37 The number of observations, deals and options are somewhat higher in the RST sample than in the SUT sample, by a factor of between 1.4 and 1.8. However, the average and median trading volumes in the SUT sample are more than double those in the RST sample. The maximum observed trading volumes are signiï¬cantly higher in the SUT sample than in the RST sample. However, the distributional statistics illustrate that this effect does not arise because of outliers. In the RST sample, from around the 50th percentile of the distribution upwards, volumes are consistently less than half the trading volumes observed in the SUT sample at comparable cut-offs of the volume distribution. Another interesting feature is that the distance between the median and the mean is roughly constant at around 100 traded contracts in the SUT sample. Statistics for the put options are statistically similar across both samples. For the entire sample, the difference between the average volume (124) before the deal announcement in the SUT sample, and the average volume (57) on a random date in the RST sample, is signiï¬cantly different from zero. The one-sided t-statistic is -6.90, implying a probability of 3 in a trillion that the trading volume observed before the announcement happened by chance. Moreover, the volumes of the SUT sample are overwhelmingly higher for the percentiles over 30%, and about the same for those less than 30%. We point out that the difference between the two samples is likely to be understated in our procedure compared to the procedure of choosing the random sample from the entire sample period. Speciï¬cally, in our case, for each event, we have a maximum of one year of data before and after the event, rather than the whole time-span of traded options from as far back as January 1996 until today. Using the whole time-span the difference would likely be even stronger. Hence, our statistical procedure is biased against failing to reject the null hypotheses stated in the previous section. 37 Since our study is conï¬ned to a limited period, due to the fact that the variance may be large, and to address the possibility that the dates chosen at random may coincide with those of other announcements, we double-checked our results using 100 random samples of 1,859 pseudo-events for the target ï¬rms, in order to minimize the standard error of our estimates. As expected, the results from this robustness check were very similar to the original results. 23

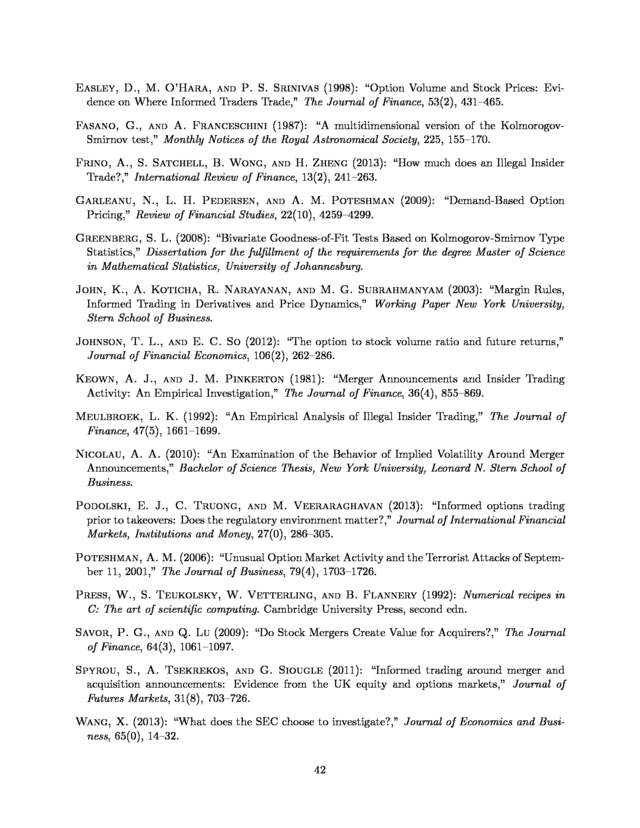

25) To summarize, the entire distribution of trading volumes differs signiï¬cantly between the SUT and RST samples for the target ï¬rms. In particular, we observe that an average trading volume above 100 contracts, with a mean-to-median distance of 100 contracts, can be considered strongly unusual and non-random when the transactions occur at a “zero-bid” within 30 days of the announcement date on options expiring after the announcement. This test provides additional evidence in favor of Hypothesis H1, showing that there is a non-random increase in the trading volume on target ï¬rms prior to public M&A announcements, particularly if we restrict ourselves to the most illiquid and leveraged options in the SUT sample. • E. Zero-Volume Runs As emphasized earlier, liquidity is low in equity options. Given the signiï¬cant number of zero-volume observations that characterize the data for equity options, we compare the proportions of non-zero trading volume between the pre-announcement period and any randomly chosen period to supplement our forensic analysis of the behavior of option volume. We also investigate proportions of non-zero trading volume conditional on there being no trading volume for the preceding one to ï¬ve days. Each observation corresponds to an option series characterized by its issuer, the type (put-call), strike and maturity. First, Panel A in Table 6 reports the volume proportions for a randomly chosen date, which turns out to be March 5, 2003. On that day, OptionMetrics contains a total of 103,496 observations, of which 28,402 are classiï¬ed as DOTM and 28,404 are classiï¬ed as DITM according to our deï¬nition of depth as the ratio of the stock price to the strike price. As expected, trading volume is generally low. Only 15% of all options were traded, about 3% were traded with more than 100 contracts, and only 0.42% were traded with more than 1,000 option contracts. The stratiï¬ed proportions reveal that the proportion of observations with non-zero trading volume is largest in the ATM category, followed by the OTM. We compare these proportions ï¬rst to those from our overall sample, in Panel B. The proportions are very similar to those observed on March 5, 2003. This is conï¬rmatory evidence that our sample is representative of a typical trading day. Panel C documents similar proportions for the ï¬ve days preceding the announcement day. 24

26) These proportions are compared to a randomly chosen sample in Panel C, where for each M&A transaction, we simulate a random pseudo-event date and look at the proportions of non-zero-volume observations in the ï¬ve days leading up to the pseudo-event. Rather than reporting standard errors, we indicate how many standard deviations the proportion in the random sample lies from that actually observed.38 The lowest difference between the proportion in the actual and random sample is four standard deviations. This value is obtained for the proportion of volumes above 1,000 contracts, for ATM options, conditional on no trading volume during the ï¬ve preceding days. For all other comparisons, the difference corresponds to at least ï¬ve standard deviations. A value of ï¬ve standard deviations corresponds approximately to a chance of 1 in a million that the randomly observed proportion would be larger than on the pre-announcement event date. As any other comparison leads to even larger differences, we believe the odds of one in a million to be a conservative estimate. • F. Characteristics of Abnormal Volume We have documented that abnormal trading volume in equity options ahead of M&A announcements is pervasive, non-random and most concentrated in OTM call options. This leaves open the question of whether certain target companies are more likely than others to exhibit unusual trading volume. In order to answer this question, we regress the cumulative abnormal option trading volume in call and put options over the 30 pre-announcement days on a set of categorical variables reflecting M&A deal characteristics and several market activity variables. We test the following benchmark speciï¬cation: CABV OL = β0 + β1 SIZE + β2 CASH + β3 T OE + β4 P RIV AT E + β5 COLLAR (5) + β6 T ERM + β7 F RIEN DLY + β8 U S + γt + ε, where CABV OL denotes the cumulative abnormal trading volume in call or put options respectively, scaled by the average normal volume over the 30 pre-announcement days.39 All 38 Note that each option volume observation follows a Bernoulli variable taking the value 1 if volume is positive (respectively larger than 100, 500 or 1,000 contracts) and 0 otherwise. Assuming independence, the sum of all observations follows a binomial distribution. The standard error of proportion p obtained from a random sample is p(1−p) given by , where N is the number of observations. N 39 We note that this analysis is based on a log transformation of volume. Hence, the scaled cumulative abnormal 25

27) speciï¬cations contain year ï¬xed effects γt , and standard errors are either robust or clustered by announcement day. First, we investigate several M&A deal characteristics that may imply a higher likelihood of informed trading. Our strongest prior is that cumulative abnormal volume should be higher for cash-ï¬nanced deals, given that cash-ï¬nanced deals are known to have higher abnormal announcement returns (as documented by Andrade, Mitchell, and Stafford (2001)). Thus, we expect that an informed trader will beneï¬t more from trading in such deals if he anticipates a higher abnormal return. We test for this by including a dummy variable CASH. In addition, “smart” insiders may prefer trading in larger companies, whose stocks (and therefore their options) tend to be more liquid, and hence, less likely to reveal unusual, informed trading. Thus, we expect cumulative abnormal volume to be higher for larger deals, measured by SIZE, a dummy variable that takes the value one if the deal is above the median transaction value, and zero otherwise. We also suspect that a bidder that has a toehold in the company (T OE) is more likely to gather information about a future takeover, and is hence more likely to trade based on his private information. Alternatively, an investor with a toehold may refrain from trading as he would be the ï¬rst suspect in any investigation. We also control for other deal characteristics, such as whether the target is taken private post-takeover (P RIV AT E), whether the deal has a collar structure (COLLAR), whether it involves a termination fee upon a failure of the deal negotiations (T ERM ), whether the deal attitude is considered to be friendly (F RIEN DLY ), and whether the bidder is a US-headquartered company (U S). The results for the benchmark regressions of cumulative abnormal volume in the target call options are reported in columns (1) and (2) of Table 7. The two single most important predictors are cash-ï¬nanced deals and the size of the target company. This evidence is consistent with our prior assumption that informed trading in target call options would be signiï¬cantly higher for cash deals, which are anticipated to have higher abnormal announcement returns, and for more liquid companies, for which it is easier to hide informed trading. Quantitatively, a target deal above the median transaction value has, on average, 3.32 % greater cumulative abnormal call trading volume relative to its normal volume than a target below the median volume is comparable across companies and interpretable as a percentage relative to normal volume. 26

28) deal size. Similarly, cash-ï¬nanced deals have, on average, 6.37 % greater cumulative abnormal volume than non-cash-ï¬nanced deals. Given that the average cumulative abnormal volume is approximately 12,000 contracts, the typical cash-ï¬nanced deal has about 764 more contracts traded during the 30 days before an announcement. The cash indicator is consistently robust across all speciï¬cations, with similar economic magnitudes. If the bidder already has a toehold in the company, cumulative abnormal volume is about 5.6 % smaller. The negative coefficient favors our second conjecture that those connected with equity stake holders with a prior interest may make more of an attempt to keep their intentions secret, given that they would be the ï¬rst suspects in the case of insider trading. Nevertheless, we point out that the coefficient on T OE loses its signiï¬cance in other speciï¬cations with additional control variables. Deals that embed a collar structure and a termination fee in their negotiations are also more likely to exhibit higher cumulative abnormal volume, by about 7.23 and 5.65 %, on average. A collar structure implicitly deï¬nes a target price range for the takeover agreement. Moreover, a termination fee makes it more likely that a negotiation will be concluded. Thus, both variables are associated with greater certainty about the magnitude of the target’s stock price increase, conditional on announcement. This is consistent with a greater likelihood of informed trading in the presence of greater price certainty. All other variables are statistically insigniï¬cant. The adjusted R2 of the regression 6%, reasonable given the likely idiosyncratic nature of the derived statistic, CABV OL, denoting the cumulative abnormal trading volume. In line with Acharya and Johnson (2010), who argue that the presence of more syndicate loan participants leads to more insider trading in leveraged buyouts (LBOs), we conjecture that the more advisors are involved in the deal negotiations, the higher is the probability of information leaking to the markets. The number of target and acquirer advisors is measured by ADV ISORS. Columns (3) and (4) report a positive coefficient, which is, however, not statistically signiï¬cant. In columns (5) and (6), we proxy for the size of the company using a dummy variable SALES, which takes the value one if the target has more sales than the median. We also include the 27

29) takeover price (P RICE), and control for the offer premium. Cumulative abnormal volume is positively associated with companies that have higher sales. Companies with above-median sales have, on average, a 3.32 % greater cumulative abnormal call volume. We have omitted the size dummy here because of potential multicollinearity issues. The coefficient of the offer premium is negative, which could be associated with the fact that, percentage-wise, it is easier to offer greater markups for low-market-capitalization ï¬rms. Also, the offer price is negatively associated with a higher cumulative abnormal volume, although the effect is statistically indistinguishable from zero. We verify whether various market activity variables have an impact on the pre-announcement cumulative abnormal call volume. We include T RU N U P , the pre-announcement cumulative abnormal stock return for the target, T AN N RET , the target’s announcement abnormal return, T T P RET 1, the target’s post-announcement cumulative abnormal return, and ARU N U P , the abnormal stock return for the acquirer before the announcement day. M KT V OL denotes the market volume on the day before the announcement day. These results are reported in columns (7) to (10). The pre-announcement run-up in the target’s stock price is strongly positively related to the cumulative abnormal volume. On the other hand, the target’s cumulative abnormal announcement return is negatively associated with the cumulative abnormal trading volume for call options. All other variables are statistically insigniï¬cant. The coefficients remain very robust for large deals that are cash-ï¬nanced, that have a collar structure, and that have a termination fee. In this ï¬nal regression speciï¬cation, the explanatory power increases to 14 %. We have repeated the analysis for cumulative abnormal volume in put options. While the results are qualitatively similar, the magnitudes of the coefficients are typically smaller. The table showing the results for put options is provided in the Internet appendix, Table A.3. To summarize, we ï¬nd that the cumulative abnormal options trading volume in call options is signiï¬cantly higher for larger M&A deals that are cash-ï¬nanced, have a collar structure, or include a termination fee. We ï¬nd a similar, but weaker, relationship for the cumulative abnormal volume of put options. Overall, our interpretation of the evidence is that informed traders are more likely to trade on their private information when the anticipated abnormal 28

30) stock price performance upon announcement is larger and when they have the opportunity to hide their trades due to greater liquidly of the target companies. Overall, our forensic analysis of the trading volume observed for equity options prior to M&A announcements conï¬rms our prior assumptions stated in Hypotheses H1 and H2. The next step is to investigate Hypotheses H3 to H6 by focusing on the information embedded in equity option prices, based on their implied volatilities and their liquidity. 5.1.2 Implied Volatility Implied volatility is the summary statistic of the price behavior of options. Using this metric of option prices, we conduct a forensic analysis over the 30 days preceding the M&A announcement date. As a complement to the volume results, we ï¬rst conduct an event study to test for the presence of positive excess implied volatility relative to a market benchmark. Second, we study the behavior of the convexity of the option smile, the relationship between the implied volatility and the strike price, in anticipation of news releases. Third, we investigate the bid-ask spread, as a measure of illiquidity, around the announcement date. Finally, we address the hypothesis related to the term structure of implied volatility, the relationship between implied volatility and the time to expiration of the option. • A. Excess Implied Volatility - Event Study We use the interpolated volatility surface in the OptionMetrics database, a three-dimensional function of the implied volatility in relation to the strike price and the time to expiration, for this exercise. To analyze the behavior of ATM implied volatility, we use the 50 delta (or a 0.50 hedge ratio) options in absolute value (for both calls and puts), and we reference the 80 and 20 delta (or 0.80 and 0.20 hedge ratios) options in absolute value for the ITM and OTM options respectively. We test two different model speciï¬cations for our results: a simple constant mean volatility model and a market model, in which we use the S&P 500 VIX index as the market’s benchmark for implied volatility. The estimation window runs from 90 to 31 days before the announcement date, while our event window relates to the 30 days before the event, excluding the announcement day itself. All standard errors are clustered by time to 29